JPMorgan downgraded Deere & Co. to Sell from Hold on Thursday ahead of the construction equipment maker’s 3Q results on August 21.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

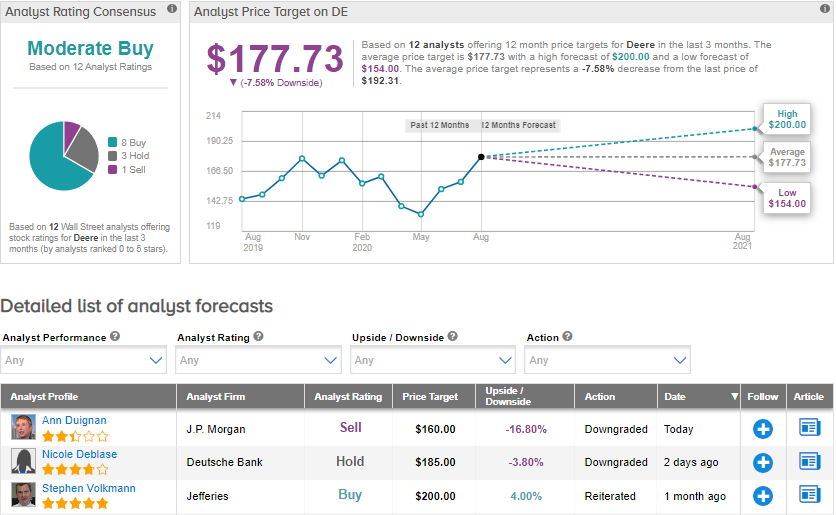

At the same time, JPMorgan analyst Ann Duignan raised the price target on Deere (DE) to $160 (16.8% downside potential) from $140. The downgrade comes after Deutsche Bank analyst Nicole Deblase on Aug. 11 cut the stock’s rating to Hold from Buy and maintained a price target of $185 (3.8% downside potential).

Deblase believes that the stock is fully priced and said that she cannot “justify a higher target multiple and/or higher earnings estimates.” The analyst sees modest downside potential to her price target.

Deere reported upbeat earnings in the last two quarters. The company’s 2Q earnings of $2.11 per share, beat the consensus estimate of $1.62 a share. 2Q revenues of $9.3 billion also topped Street estimates of $7.7 billion. However, Deere warned that full-year sales will decline this year as the COVID-19 pandemic weighs on demand for agricultural and industrial equipment.

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 8 Buys, 3 Holds and 1 Sell. The average price target of $177.73 implies downside potential of about 7.6%. (See DE stock analysis on TipRanks).

Related News:

Piper Sandler Lifts NIO’s PT After ‘Solid’ 2Q Results

Deutsche Bank Cuts Micron To Hold Amid Lower Memory Pricing Bet

Gabelli Cuts Zoetis To Hold On Valuation