JP Morgan Chase (NYSE:JPM) shares are plunging today despite the financial giant reporting better-than-expected first-quarter numbers, due to a lackluster financial outlook.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

JPM’s Q1 Numbers

JPM’s Q1 top line expanded by 9.5% year-over-year to $41.93 billion, exceeding consensus by $240 million. Similarly, its EPS of $4.63 outpaced expectations by $0.46. The bank’s net income increased to $13.42 billion from $12.62 billion a year ago. At the same time, its provision for credit losses declined to $1.88 billion from $2.27 billion. Net interest income (NII) for the quarter stood at $23.2 billion, an increase of 11%.

A Mixed Picture

JPM’s first quarter was marked by higher asset management fees and an uptick in investment banking fees. At the same time, its noninterest expense shot up by 13% to $22.8 billion, owing to higher compensation expenses and an increase of $725 million to the FDIC special assessment (reflecting the FDIC’s revised estimated losses). Net income attributable to First Republic stood at $668 million.

At the same time, the company’s NII pointed to a 4% sequential decline. Jamie Dimon, the CEO and Chairman of JPM, noted that the company experienced deposit margin compression and lower deposit balances, primarily in its CCB (Consumer & Community Banking) unit. However, Dimon sees NII and credit cost trends normalizing over the coming periods.

JP Morgan’s Outlook Disappoints

Importantly, JPM’s financial outlook failed to impress investors. The company estimates Fiscal year 2024 NII at $90 billion. Adjusted expenses for the year are seen landing at $91 billion. The unchanged NII expectations disappointed investors are markets are largely expecting fewer rate cuts this year.

Is JPM a Buy, Sell, or a Hold?

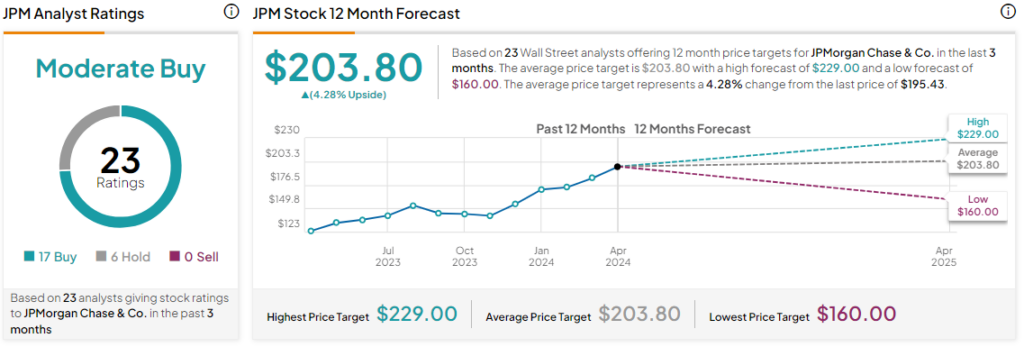

Today’s price decline comes after a nearly 56% jump in JPM’s share price over the past year. Overall, the Street has a Moderate Buy consensus rating on the stock, alongside an average JPM price target of $203.80. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure