The troubles at Johnson & Johnson (NYSE:JNJ) are mounting as legal punches keep coming. According to Reuters, the pharmaceutical giant has recently been hit with a new class action lawsuit. The lawsuit seeks damages and medical monitoring for women diagnosed with, or at risk of, cancer from using the company’s talc products.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

New Lawsuit Adds Pressure on JNJ

This new lawsuit comes nearly a week after Johnson & Johnson agreed to settle cases alleging it misled consumers about the safety of its talcum-based products. It’s worth noting that the scrutiny over JNJ’s talc products has intensified over the past several years due to potential health risks.

In a significant move in May 2024, JNJ announced a $6.5 billion settlement plan to resolve nearly all U.S. lawsuits claiming its talc-based products caused ovarian cancer. This move is part of the company’s strategy to mitigate ongoing litigation risks and restore investor confidence.

However, the resistance from law firms behind this latest case complicates the company’s efforts to settle these claims.

The Road Ahead

Johnson & Johnson’s vice president of litigation said the latest lawsuit is baseless. He believes the plaintiffs’ lawyers filed it to make more money. Despite this, legal uncertainties and the financial burden of these settlements pose potential risks to the company’s profitability and stock performance.

According to TipRanks’ Risk Analysis tool, JNJ’s legal and regulatory risk exposure is much higher than the industry average. Its legal and regulatory risks account for 36.4% of its overall risks. In comparison, the industry average is 19%. This is a cause for concern.

Is JNJ Stock a Buy?

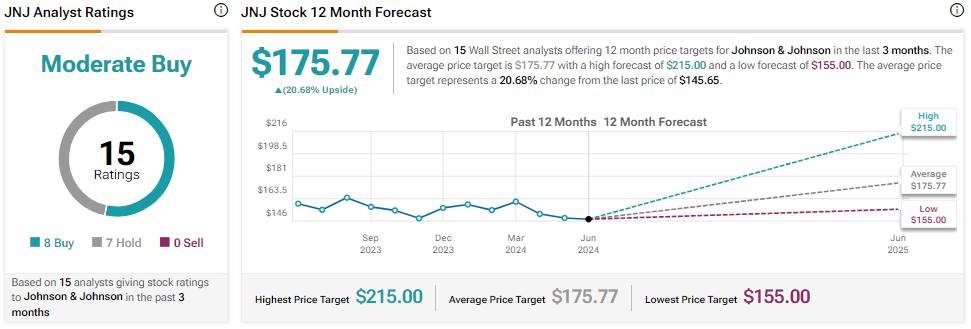

JNJ stock is down about 5.6% year-to-date, underperforming the benchmark indices. Analysts are cautiously optimistic about JNJ’s prospects. With eight buys and seven Hold recommendations, JNJ stock has a Moderate Buy consensus rating.

The analysts’ JNJ stock price target is $175.77, implying 20.68% upside potential from current levels.