Healthcare giant Johnson & Johnson (JNJ)is gearing up to release its first-quarter 2025 financials on April 15. JNJ stock has gained over 5% year-to-date, mainly due to solid financials, a sales boost from its recent Intra-Cellular Therapies acquisition, and steady investor returns through consistent dividend payouts. Wall Street analysts expect the company to report earnings of $2.58 per share, representing a 4.8% decrease year-over-year.

Meanwhile, revenues are expected to increase by about 1% from the year-ago quarter to $21.56 billion, according to data from the TipRanks Forecast page.

Analysts’ Views Ahead of JNJ’s Q1 Earnings

Ahead of Johnson & Johnson’s Q1 earnings, Bank of America Securities analyst Tim Anderson maintained his Hold rating on the stock and decreased the price target from $171 to $159 per share, citing concerns over new tariffs.

For Q1, the firm retained its revenue forecast but expects earnings to decrease by 2% due to expected pressure on profit margins and higher costs. Looking ahead to 2025, BofA expects modest revenue growth from new products and recent acquisitions. However, he believes earnings may dip slightly due to currency headwinds and acquisition-related dilution.

Meanwhile, Goldman Sachs analyst Asad Haider upgraded JNJ from Neutral to Buy and raised the price target to $172 from $157. He believes worries about the loss of patent protection for drugs like Stelara are overdone. According to him, JNJ’s Innovative Medicine unit, which brings in most of the company’s profits, should continue to perform well.

Options Traders Anticipate a Minor Move

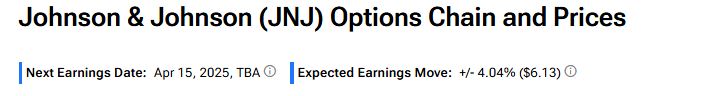

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 4.04% move in either direction.

Is Johnson & Johnson a Good Stock to Buy?

Turning to Wall Street, Johnson & Johnson stock has a Moderate Buy consensus rating based on seven Buys and eight Holds assigned in the last three months. At $169.00, the average JNJ price target implies 11.38% upside potential.