Shares of Johnson & Johnson (NYSE:JNJ), a major healthcare company, gained in trading after the company reported adjusted earnings for its second quarter of $2.82 per share, an increase of 10.2% year-over-year, and above analysts’ consensus estimate of $2.71 per share.

JNJ’s Sales Breakdown

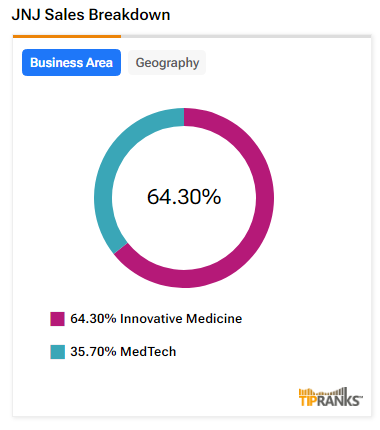

Sales increased by 4.3% year-over-year, with revenue hitting $22.4 billion. This beat analysts’ expectations of $22.3 billion. The company operates in two business segments: its pharma unit, Innovative Medicine, and its MedTech business, which provides robotic-assisted surgical solutions.

The Innovative Medicine business comprised more than 60% of JNJ’s revenues in the second quarter. This business generated revenues of $14.5 billion in the second quarter, up by 8% year-over-year on an adjusted operational basis.

Additionally, the MedTech business reported Q2 revenues of $7.9 billion, an increase of 4% year-over-year on an adjusted operational basis.

JNJ’s FY24 Outlook

Looking forward, the management increased its FY24 operational sales guidance to reflect its acquisition of Shockwave Medical. The company expects operational sales to be in the range of $89.2 billion to $89.6 billion and estimates an increase of 6.4% at the midpoint of its guidance. JNJ trimmed its FY24 adjusted earnings outlook to be between $9.97 and $10.07 per share compared to its prior guidance in the range of $10.57 to $10.72 per share.

Is JNJ Stock a Buy or Sell?

Analysts remain cautiously optimistic about JNJ stock, with a Moderate Buy consensus rating based on eight Buys and six Holds. Over the past year, JNJ has increased by more than 1.2%, and the average JNJ price target of $174.38 implies an upside potential of 11.6% from current levels. These analyst ratings are likely to change following JNJ’s Q2 results today.