Johnson & Johnson (JNJ) reported better-than-expected results for the third quarter on Wednesday. This was even as the medical technology and biotech company’s adjusted earnings declined by 9% year-over-year to $2.42 per share, which exceeded analysts’ consensus estimate of $2.21 per share.

JNJ’s Q3 Sales Driven by Oncology Drugs

The company clocked in sales of $22.5 billion in Q3, up by 5.2% year-over-year, above analysts’ expectations of $22.2 billion. JNJ’s growth in revenues was driven by the sales of its oncology drugs, which climbed nearly 19% globally during the quarter, fueled by impressive growth in its cancer treatment, Darzalex.

Notably, Darzalex generated sales of over $3 billion in the third quarter, an increase of 20.7% year-over-year. Darzalex is a part of the company’s Innovative Medicine business segment, which comprised more than 60% of JNJ’s total revenues in the third quarter.

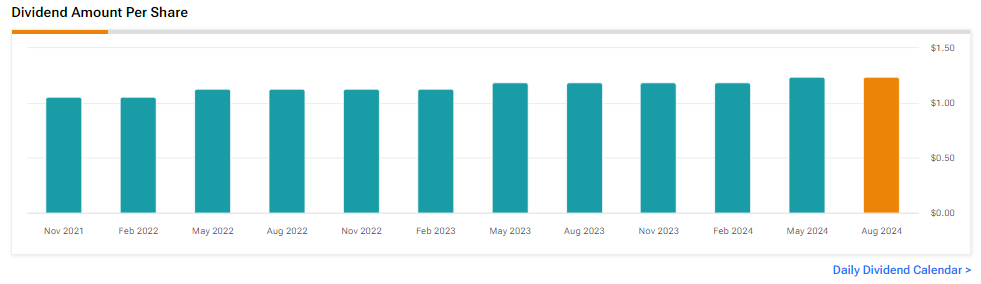

JNJ Announces Quarterly Dividend

In addition, the company announced a quarterly dividend for the fourth quarter of $1.24 per share, payable on December 10 to shareholders of record at the close of business on November 26, 2024.

JNJ Raises FY24 Sales Forecast

Looking ahead, management raised its FY24 guidance and now expects operational sales to be in the range of $89.4 billion to $89.8 billion, compared to its prior forecast of between $89.2 billion and $89.6 billion. Furthermore, adjusted earnings are estimated to be in the range of $9.88 to $9.98 per diluted share, compared to its prior forecast between $9.97 and $10.07 per share. For reference, analysts were expecting an adjusted EPS of $9.95 per share.

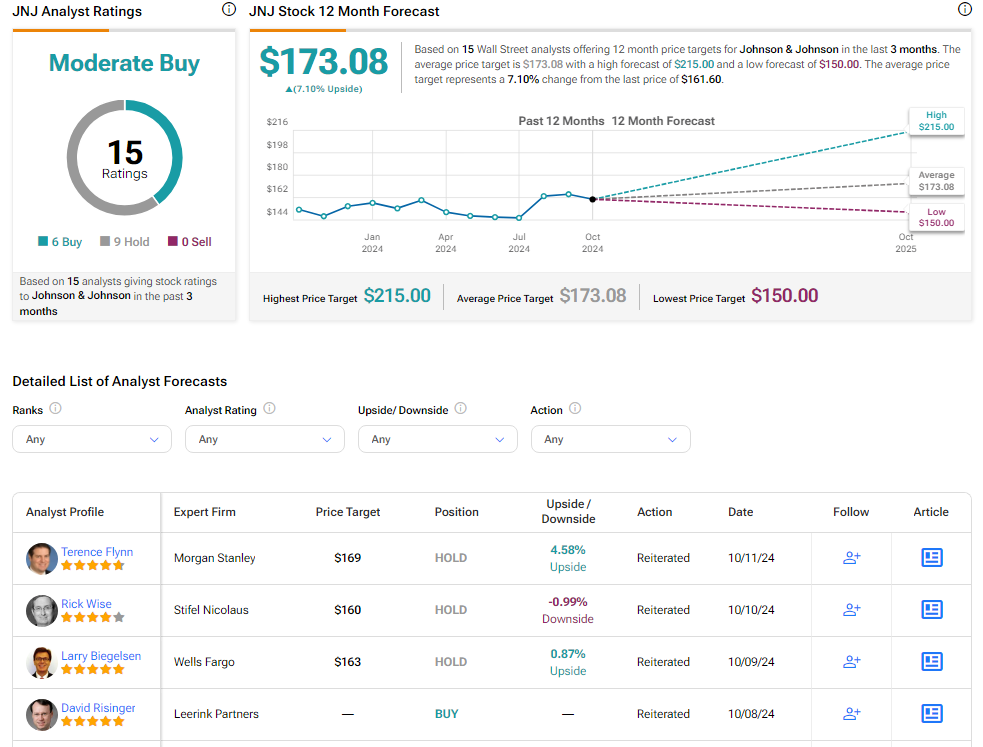

Is JNJ Stock a Buy or Sell?

Analysts remain cautiously optimistic about JNJ stock, with a Moderate Buy consensus rating based on six Buys and nine Holds. Over the past year, JNJ stock has increased by more than 5%, and the average JNJ price target of $173.08 implies an upside potential of 7.1% from current levels. These analyst ratings are likely to change following JNJ’s Q3 results today.

Questions or Comments about the article? Write to editor@tipranks.com