Shares of low-cost airline company JetBlue Airways (NASDAQ:JBLU) gained over 16% in Monday’s after-hours of trading as activist investor Carl Icahn disclosed a 9.91% stake in the company. Icahn’s bullish stance on JBLU stock stems from his belief that it is undervalued and presents an attractive buying opportunity. Additionally, he is in discussions with JetBlue’s management about potential board representation.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

The move comes at a time when JetBlue is struggling to grow sales and profitability. Notably, the company’s operating revenue declined by 8.2% and 3.7% in the third and fourth quarters of 2023, respectively. Further, JBLU reported an adjusted loss per share of $0.39 and 0.19 in Q3 and Q4, respectively.

The company has announced revenue enhancement initiatives and cost-saving programs in response to these challenges. While JBLU’s ongoing fleet modernization and structural cost programs helped the company generate cost savings of nearly $70 million in 2023, its stock fell approximately 29% over the past year, significantly underperforming the S&P 500’s (SPX) gain of 21.5%.

Is JBLU a Buy or Sell?

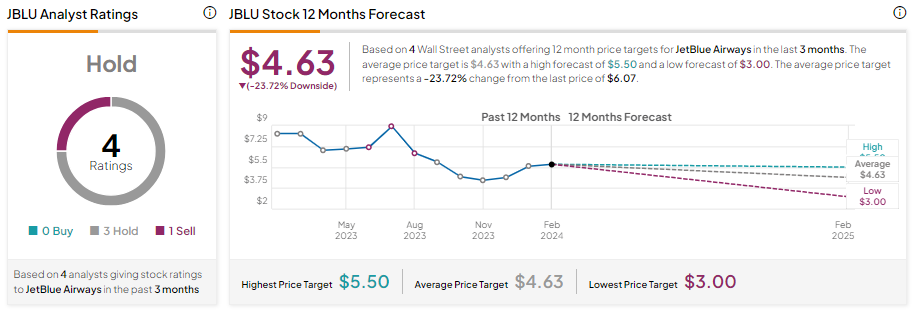

Though Icahn has the potential to influence JetBlue’s board to implement strategies for faster growth, analysts remain sidelined as JBLU may continue to report losses in the near term. With three Hold and one Sell recommendations, JBLU stock has a Hold consensus rating.

Analysts’ average price target of $4.63 implies 23.72% downside potential from current levels.