JD.com, Inc. (JD), a Chinese technology-driven e-commerce company, which is transforming into a supply chain-based technology and service provider, posted better-than-expected Q1 results driven by strong revenues. Shares increased 1.2% to close at $70.58 on May 19.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

JD.com’s Q1 earnings came in at $0.38 (RMB2.47) per ADS, versus the consensus estimate of $0.35 per ADS. The company reported earnings per ADS of RMB1.98 in the same quarter last year.

Net revenues of $31 billion (RMB203.2 billion) increased 39% from the year-ago period and outpaced analysts’ expectations of $29.8 billion. Results were supported by outstanding performance in both services and product sectors. (See JD.com stock analysis on TipRanks)

JD’s Retail segment reported revenues of $28.4 billion (RMB185.8 billion) in the quarter, up 35.2% year-over-year. Additionally, revenues at JD Logistics grew 63.5% to $3.4 billion (RMB22.4 billion).

JD.com CEO Richard Liu said, “Since our establishment, JD’s focus on customers has set us apart and today we are proud that 500 million active users rely on JD’s broad selection of quality products and best-in-class customer services to support every aspect of their lives. JD is also increasingly the partner of choice for millions of businesses who benefit from our advanced supply-chain infrastructure to reduce costs and boost operating efficiency.”

Following the Q1 results, Stifel Nicolaus analyst Scott Devitt assigned a Buy rating and a price target of $95 (34.6% upside potential) to the stock.

Devitt expects “stable margins in 2Q for JD Retail on a y/y basis as the company compares against one-time benefits in 2Q:20 stemming from government incentives related to the pandemic.”

Furthermore, the analyst continues to anticipate “measured investments in the company’s key strategic areas, including supply chain and logistics, omnichannel, and social commerce,” to limit margin expansion in 2021.

“We are modestly raising our FY revenue estimates, reflecting ongoing strength in customer acquisition, though leaving our margin forecast unchanged,” he added.

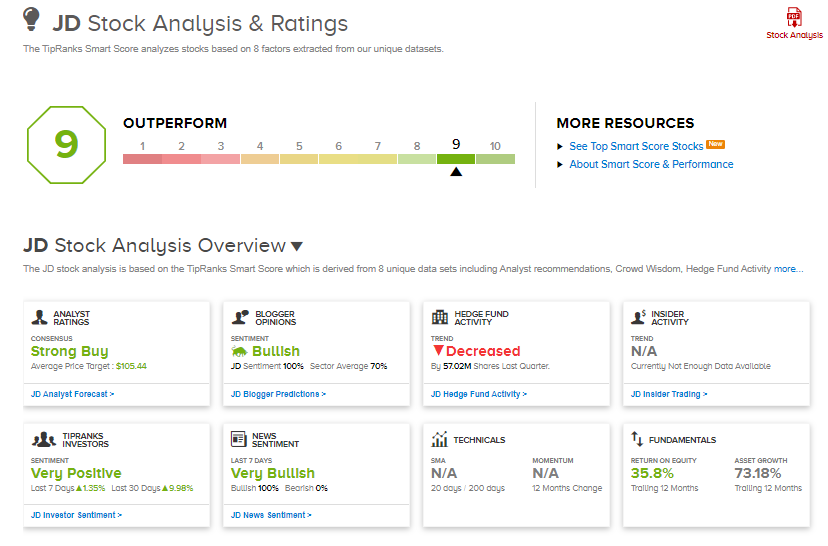

Consensus among analysts is a Strong Buy based on 15 Buys and 1 Hold. The average analyst price target stands at $105.44 and implies upside potential of 49.4% to current levels. Shares have gained almost 30% over the past year.

JD.com scores a 9 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

CAE Q4 Profit Drops 77% on Weaker Aviation Demand; Shares Plunge 8%

Agiliti Posts Strong Q1 Results After IPO

Transcat’s Q4 Results Beat Expectations; Shares Dip