Shares of J.B. Hunt Transport Services (NASDAQ:JBHT) dropped 6% in Tuesday’s after-hours trading. The company’s lower-than-expected Q1 financials and ongoing margin headwinds weighed on its stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company, which provides transportation and logistics services, delivered revenue of $2.94 billion, down 9% year-over-year. Moreover, its top line missed the Street’s estimate of $3.11 billion. Weaker demand for its domestic intermodal service offering, a decline in average trucks, lower contractual and transactional rates, and changes in customer freight mix impacted revenues.

The year-over-year decline in sales and inflationary cost pressures weighed on JBHT’s bottom line. JBHT delivered earnings of $1.22 per share, down 35% year over year. Moreover, it missed the Street’s expectation of $1.50.

JBHT’s Margins to Stay Under Pressure

JBHT is focusing on improving revenue quality and volume growth. Moreover, it is optimizing its cost structure and improving the efficiency of its network to support margins. However, inflationary headwinds stemming from insurance premiums and labor costs are likely to remain a drag.

Moreover, higher equipment and maintenance expenses could continue to pose challenges.

Goldman Sachs analyst Jordan Alliger expects little improvement in the pricing environment, leading to a negative impact on intermodal revenue per load and margins in the first half of 2024. However, Alliger reiterated a Buy on JBHT on April 16 and sees an upward volume and price trajectory in late 2024.

What Is the Stock Price Prediction for J.B. Hunt?

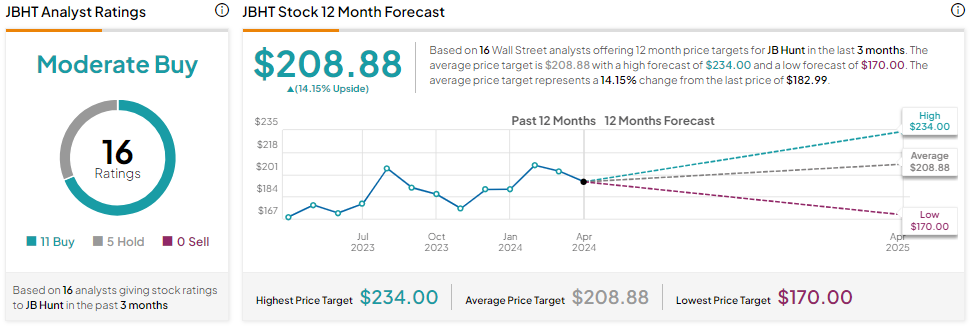

J.B. Hunt stock is down over 8% year-to-date. Meanwhile, Wall Street maintains a cautiously optimistic outlook on the stock. It has a Moderate Buy consensus rating based on 11 Buy and five Hold recommendations. Analysts’ average price target on JBHT stock is $208.88, implying 14.15% upside potential from current levels.