Japan-based Mizuho Financial Group (JP:8411) has lifted its annual profit outlook for FY24 after achieving soaring profits in Q2. The company now expects annual profits of ¥820 billion, up from an earlier forecast of ¥750 billion. Following the results, Mizuho Financial Group shares gained 1.32% in today’s session.

Mizuho Financial is a holding company offering a range of financial services, including banking, securities, etc.

Mizuho Reports Strong Q2 Profits

In the second quarter, Mizuho reported a group net profit of ¥277 billion, as compared to ¥170 billion a year ago. Meanwhile, profits increased 36% year-over-year in the first half to ¥566.1 billion.

Overall, the company’s performance was driven by robust lending demand and increased margins following the Bank of Japan’s interest rate hike to 0.25% in July. For several years, Japanese banks faced pressure on their lending margins due to negative interest rates. However, moving forward, lending income is expected to grow in Japan as a result of the rate increase.

Mizuho Increases Dividend Forecast

Highlighting its strong results, Mizuho raised its annual dividend forecast to ¥130 from ¥115 announced in May. This also represents an increase from the ¥105 paid in FY23.

The company also announced a rare share buyback of 50 million shares worth ¥100 billion. This buyback is expected to be complete by mid-March 2025.

Is Mizuho Stock a Buy?

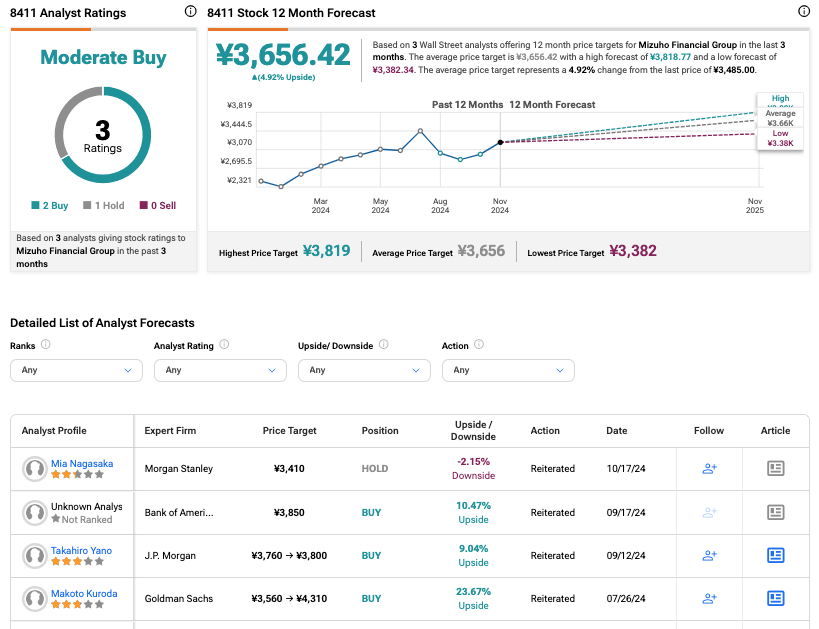

As per the consensus among analysts on TipRanks, 8411 stock has been assigned a Moderate Buy rating based on two Buys and one Hold recommendation. The Mizuho Financial share price target of ¥3,656.42 implies an upside of 5% from the current share price level.