Taiwan Semiconductor Manufacturing Co. (TSM) or TSMC will collaborate with Japanese companies on a government-backed project to advance chipmaking technologies in Japan.

According to Nikkei Asia, Japan’s position in the global semiconductor industry has been declining. In a bid to improve the country’s competitiveness, the government sought TSMC’s help.

As a result, TSMC will set up a research and development facility in Japan in partnership with the government. It will use that facility to collaborate with more than 20 Japanese companies on semiconductor technology advancements. The participating companies will include Ibiden, Asahi Kasei, Shin-Etsu Chemical, Shibaura Mechatronics, and Nagase.

TSMC will invest about $337 million in the project, which is about half of the project’s cost. The Japanese government will also fund the project. The research facility will be set up at the National Institute of Advanced Industrial Science and Technology in Ibaraki Prefecture. The project will begin with a trial before entering full operation in 2022.

In addition to helping advance Japan’s chip technology, the Japanese government is also expecting TSMC to set up a manufacturing plant in the country. TSMC is the world’s largest contract chipmaker with customers including Apple (AAPL) and Qualcomm (QCOM). (See TSMC stock analysis on TipRanks)

On April 15, Susquehanna analyst Mehdi Hosseini reiterated a Sell rating on TSM but raised the price target from $83 to $85, implying 27.57% downside potential. The analyst observed that TSMC’s $100 billion capex plan would drive revenue growth for the next three years, but depreciation and higher operating expenses will weigh on earnings.

“Strengthening demand environment, in our opinion, is enabling TSM to increase wafer prices across most nodes, though the sustainability of wafer price increase into 2022 and beyond is not clear,” noted Hosseini.

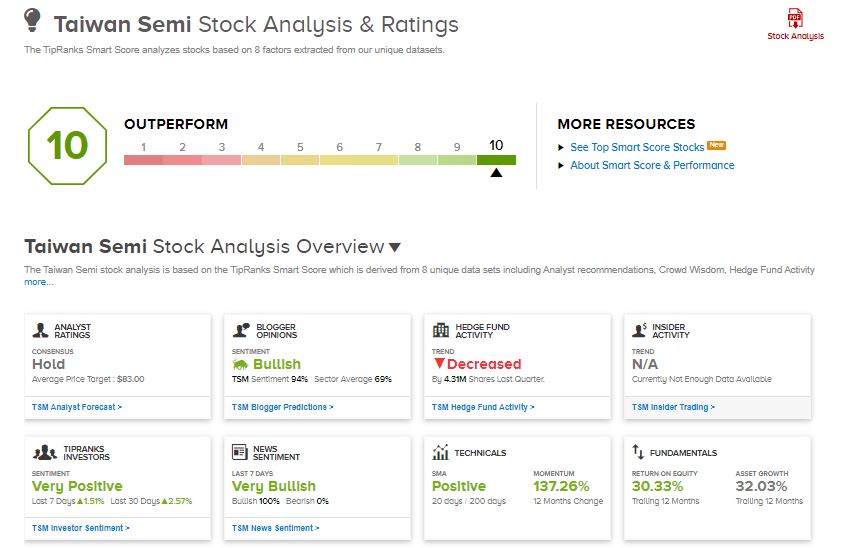

Consensus among analysts on Wall Street is a Hold based on 1 Buy, 2 Hold, and 1 Sell ratings. The average analyst price target of $83 implies a 29.28% downside potential from the current price.

TSM scores a “Perfect 10” on TipRanks’ Smart Score rating system, suggesting the stock is likely to outperform the market.

Related News:

Verizon Partners with AiFi to Enable Seamless Shopping At Indy 500

Bank of Nova Scotia Earnings Preview: Here’s What to Expect

Airbnb: A Category Leader Poised for Long-Term Growth