Sometimes, all it takes to send a stock careening toward the bargain basement is to just have the CEO come out and kill all hope. Publicly. That’s what Jamie Dimon just did with JPMorgan (NYSE:JPM), as shares of the bank plunged over 4% in the closing minutes of Monday’s trading session. The hope Dimon butchered was that JPMorgan might start on another round of share buybacks.

But Jamie Dimon took one look at JPMorgan’s share price, with a valuation running over twice its tangible book value, and made it pretty clear that wasn’t happening, not in any serious quantity. Dimon noted that such a move would be “a mistake” and then got particularly clear, noting, “We aren’t going to do it.”

Dimon, meanwhile, plans to sit on excess capital, which might be necessary in the not-too-distant future as Dimon finds himself “cautiously pessimistic” about the economy as a whole right now. Dimon pointed to “…the most complicated geopolitical situation since World War II,” and quantitative tightening as destabilization continues in earnest.

“It’s Not Five Years Any More”

Back during JPMorgan’s investor day events, Dimon noted that “we’re on the way, we’re moving people around,” which suggested that he may have plans to retire sooner than some might expect. In fact, Dimon is 68, which puts him in a pretty good position to be thinking about retirement. Given that he perpetually jokes that his retirement is five years away any time he’s asked, it’s left a lot of frustrated market watchers in its wake. But he did narrow it down at investor day, saying that it’s “not five years any more.”

Is JPM Stock a Buy, Sell, or Hold?

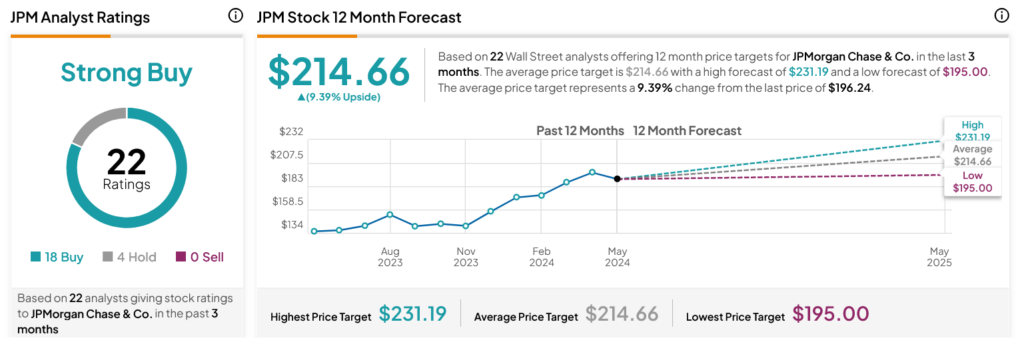

Turning to Wall Street, analysts have a Strong Buy consensus rating on JPM stock based on 18 Buys and four Holds assigned in the past three months, as indicated by the graphic below. After a 45.89% rally in its share price over the past year, the average JPM price target of $214.66 per share implies 9.39% upside potential.