News headlines have been dominated of late with discussions of Tesla’s (NASDAQ:TSLA) growth plans: Will Tesla build a Model 2 mass-market EV for example, or jettison that project to focus on robotaxis instead? Does Tesla really intend to abandon its leadership in EV charging, or was there some other reason it fired its entire Supercharging department in April?

In a series of investor meetings, JPMorgan analyst Ryan Brinkman met with Tesla’s investor relations director, Travel Axelrod (whose name seems either very fitting for an auto company IR boss or might be a pseudonym), in an attempt to shed light on these pressing questions.

The first item on Brinkman’s agenda, therefore, was to get Axelrod to give a clear explanation of which direction Tesla is driving. Tesla’s response was essentially a restatement of what it has said previously, however. “Lower cost models” are coming by 2025. But they won’t be a “next generation platform” (i.e. a Model 2), which is farther down the pike. In the near term, investors should instead expect to see something that can be built using “existing platforms and assembly lines.”

Brinkman’s read on what this means for investors is two-fold. First, Tesla will probably save on capital costs by not retooling to produce an entirely new model (albeit at the cost of foregoing any revolutionary gains in production efficiency). And second, the introduction of lower-cost models should help to boost sales at Tesla – both things that should please investors.

As regards the Supercharging snafu, meanwhile, Axelrod promised “continued strong growth in energy storage, services,” which could refer either to home batteries, or to a continued buildout of the Supercharging network – or both. At the same time, he echoed his CEO’s insistence that “autonomy” (i.e. FSD) will be “a more meaningful contributor” to profits in the future – which implies that Musk is still intent on building his robotaxis.

Following-up on that question, Brinkman was able to get Axelrod to confirm that Tesla is at least inching away from its plan to have customers rent out their own personal Teslas to perform robotaxi functions, and will instead “augment” this installed base of cars by building “a dedicated robotaxi vehicle” to serve as the core of its taxi fleet.

Axelrod actually insisted that Tesla has “all along intended to pursue a two-pronged approach” like this. Which is curious, considering that Axelrod also asserted that any dedicated robotaxis Tesla builds will actually be cheaper to produce than Teslas-that-can-be-used-as robotaxis. If that’s true, one wonders why just building an all-robotaxi fleet wasn’t the plan from the get-go.

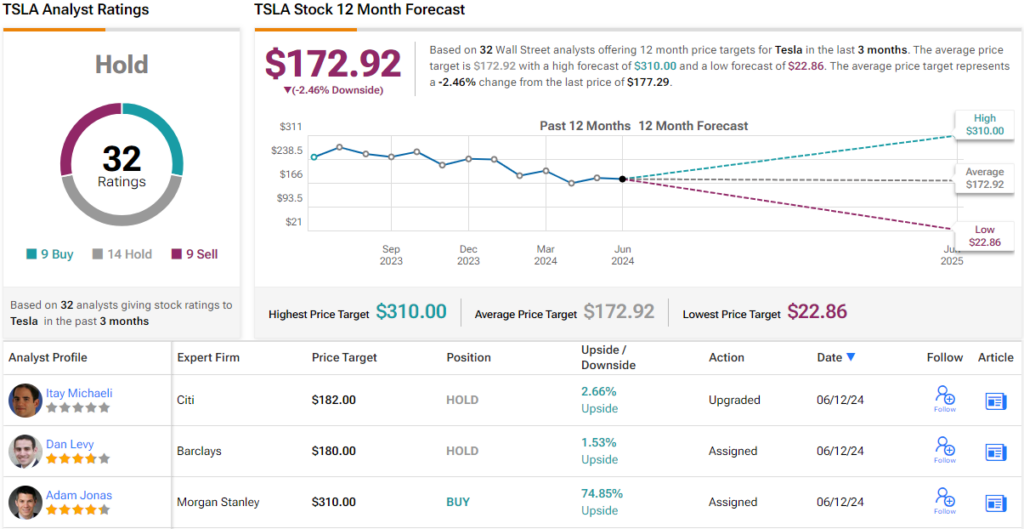

Overall, Brinkman remains cautious, rating Tesla shares as Underweight (i.e. Sell), with a $115 price target, implying a 35% downside from current levels. (To watch Brinkman’s track record, click here)

A look at the consensus breakdown does not inspire much confidence either. TSLA stock’s Hold (i.e. neutral) consensus rating is based on 9 Buy recommendations, 14 Holds and 9 Sells. Over the next 12 months, shares are anticipated to remain rangebound, given the average price target stands at $172.92. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.