It’s probably safe to say Elon Musk usually gets what he wants but is he pushing the goal post out a bit too much this time around?

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

That remains to be seen after a series of tweets by the Tesla (NASDAQ:TSLA) CEO. In these, Musk stated his demand for 25% voting control, otherwise he would be “uncomfortable growing Tesla to be a leader in AI & robotics.” Moreover, Musk said that should the board decline to acquiesce, he would “prefer to build products outside of Tesla.”

Right now, Musk controls ~13% of Tesla shares, although he used to own ~22% before selling a big chunk of his holdings to fund the 2022 purchase of Twitter (now X).

Whichever way you look at it, the whole saga is bad news for the company and stock, says J.P. Morgan analyst Ryan Brinkman.

“We are highly uncertain of how this may play out but still view the events negatively for Tesla shares for several reasons,” says the analyst, “including: (1) the odds of a CEO departure appear to have risen, with clear negative implication for the shares; (2) the cost to non-Musk shareholders of avoiding such a fate now appears higher than imagined; and (3) the manner in which investors are learning of these details could cause them to question corporate governance issues.”

To achieve a 25% stake in Tesla would require the “effective dilution of other investors’ stakes.” This is likely to be achieved through the implementation of a new compensation plan, as Musk indicated in his tweets. However, the execution of this plan is currently on hold, pending the resolution of legal issues related to his prior package.

Both Tesla’s CEO and valuation are “highly unique” and going by past events are “indelibly linked” with Musk’s comments often causing big moves in the stock. Its valuation is in no way tied to the prospect of margins improving or claiming a bigger share of the global EV market, but rather to Tesla “side bets,” including autonomous robo-taxis /Full Self-Driving, and the TeslaBot, both which fall under the “AI & robotics” category.

As Brinkman notes, should the board not play ball, and Musk actually decides to leave, lacking his “vision and leadership,” Brinkman reckons investors would “assess Tesla’s potential in AI and robotics to be much less promising – particularly if he might ‘build [potentially competing?] products outside of Tesla.’”

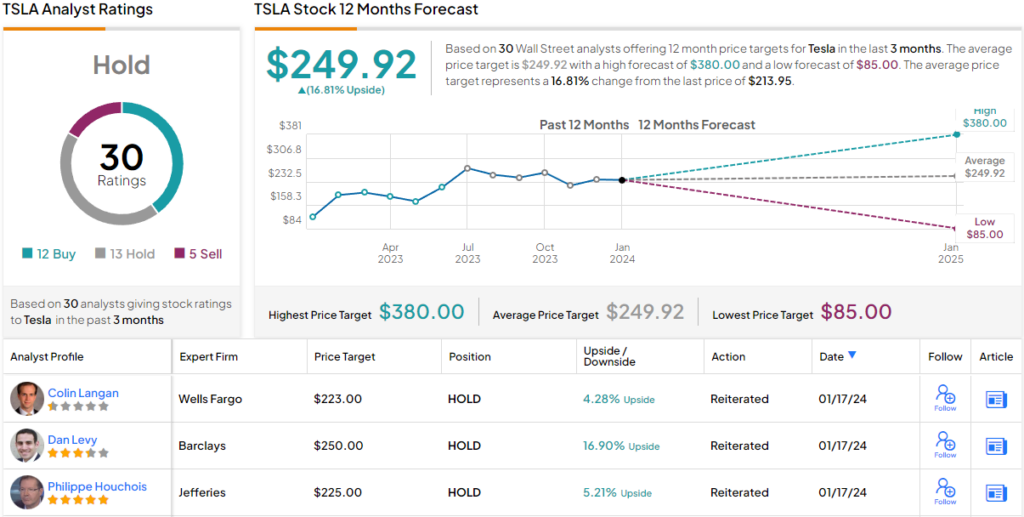

It’s uncertain how the story will unfold, but for now, Brinkman maintained an Underweight (i.e., Sell) rating for the shares, along with a $135 price target. That figure sits 37% below the current share price. (To watch Brinkman’s track record, click here)

4 other analysts join Brinkman in the bear camp, and with an additional 12 Buys and 13 Holds, the stock receives a Hold consensus rating. Going by the $249.92 average target, a year from now, shares will be changing hands for a 17% premium. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.