Food and beverage maker J.M. Smucker Company (SJM) reported better-than-expected Q4 results. Shares rose 1.4% to close at $137.88 on June 3.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Notably, the company completed the divestiture of the Crisco business on December 1, 2020, and the divestiture of the Natural Balance business on January 29, 2021.

Adjusted earnings stood at $1.89 per share in Q4, a decrease of 26.5% year-over-year. However, earnings surpassed the Street’s estimates of $1.67 per share.

Net sales for the quarter declined 3% (excluding divestitures) to $1.92 billion, compared to the Street’s estimates of $1.88 billion. Results were impacted by the pandemic.

During the quarter (excluding divestitures), U.S. retail pet foods sales declined 6% to $674.6 million, while U.S. retail coffee sales remained flat at $583.1 million. Additionally, U.S. retail consumer foods sales increased 1% to $419.8 million, while International and away from home sales fell 5% to $242.7 million. (See J.M. Smucker stock analysis on TipRanks)

Mark Smucker, President and CEO of the company said, “Looking ahead to fiscal year 2022, we are focused on building upon the momentum and exceptional results we delivered this year, advancing our consumer-centric growth strategy.”

Looking ahead, the company projects FY22 net sales to decline 2% to 3% year-over-year, and adjusted earnings to fall in the range of $8.70 – $9.10 per share. The Street estimates earnings of $8.60 per share.

Following the results, Jefferies analyst Robert Dickerson lifted the price target on the stock to $144 (4.4% upside potential) from $135 while maintaining a Hold rating.

Dickerson said, “Although the company operates in solid long-term growth potential categories (coffee and pet food) and has a new go-forward strategy, which focuses on commercial excellence, streamlined costs, and portfolio optimization, questions still remain regarding the pace of top-line growth acceleration and margin expansion amidst further brand-building needs and cost inflation headwinds.”

The stock has a Hold consensus rating based on 5 Holds and 1 Sell. The average analyst price target of $131.67 implies 4.5% downside potential from current levels. Shares have gained 26.4% over the past year.

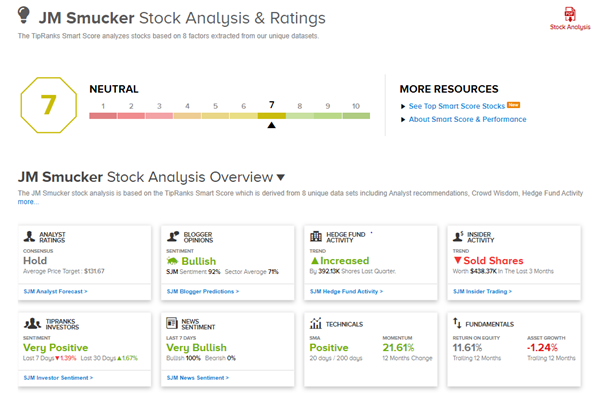

According to TipRanks’ Smart Score system, Smucker gets a 7 out of 10, which indicates that the stock is likely to perform in line with market averages.

Related News:

Guidewire Reports Q3 Loss, Revenues Beat Expectations

Elastic Posts Smaller-than-Expected Quarterly Loss; Shares Pop 13% After-Hours

Semtech Reports Robust Q1 Results, Beats Expectations