The investment thesis for Itaú Unibanco (NYSE:ITUB), Latin America’s largest traditional bank, focuses on combining efficiency, quality, and attractive shareholder returns via dividends and equity interest. This forms the basis of my bullish stance on ITUB stock.

Itaú is arguably the most consistent performer among Brazilian private banks today. Despite facing headwinds from an adverse credit environment in Brazil, its above-average efficiency has enabled it to generate capital organically, boasting an ROE that exceeds 20%.

There’s also potential for dividend payouts to increase over the coming years, making it a promising prospect for income-oriented investors.

Overview of Itaú Unibanco and Latin American Banking

In the Latin American banking scene, particularly in Brazil, Itaú stands out as the main traditional bank (excluding digital ones like Nu Holdings (NYSE:NU)). The sector is dominated by state-owned giants Banco do Brasil (OTC:BDORY) and Caixa Econômica Federal, along with private players Bradesco (NYSE:BBD) and Santander Brasil (NYSE:BSBR).

While they all compete, each bank has its niche. Itaú, for example, caters more to high-income clients. One of Itaú’s key strengths is the quality of its assets, a testament to its diversified approach. In terms of products, Brazil accounts for more than 80% of the bank’s assets, while the rest are spread across Latin America.

Recently, the Brazilian banking scene has faced a pronounced credit growth slowdown, impacting ITUB’s performance. Meanwhile, rising delinquency levels have created a tense situation, weighing on bank stocks.

Despite these macro headwinds, Itaú’s fundamentals have remained robust. However, these challenges have been the main reason behind the underperformance of ITUB shares this year.

Where ITUB Stock Stands Out

Putting Itaú’s strong fundamentals into numbers, let’s start with its impressive ROE. Itaú’s reported an ROE of 21.9%, which matches Banco do Brasil at 21.7% and outshines its private peers such as Santander Brasil and Bradesco, whose yearly ROEs were 14.1% and 10.4%, respectively.

This efficiency has been achieved through a blend of cost reductions and branch closures, as well as the optimization of new revenue streams. These new sources have come from the bank’s super app, enhanced cross-selling and up-selling, and an app focused on small and medium-sized businesses.

Currently, Itaú’s efficiency ratio is 38.3%, down from 40.3% in the first quarter of 2023. A lower ratio indicates higher efficiency for the bank.

Another highlight of Itaú’s is its high-quality credit, backed by robust management. Its 90-day delinquency rate (NPL 90+) is at 2.7%, better than its peers and much stronger than digital banks like Nu Holdings, which has a delinquency rate of 6.3%. This low default rate reflects the bank’s selective approach to client expansion. From December 2022 to December 2023, the Corporate portfolio grew by 8%, whereas the Individual portfolio grew by 4%.

Finally, Itaú trades at a price-to-book ratio of 1.6x, higher than the industry average of 1.1x. This premium, in my view, reflects the bank’s efficiency, especially compared to other incumbents. Yet, it’s much more discounted than Nu Holdings’ P/B of 8.7x, which boasts a very aggressive growth profile.

ITUB’s Dividend Potential

Considering Itaú’s ability to maintain an ROE above 20%, even during periods of credit retraction in Brazil, its organic capital generation has stayed strong. In 2023, Itaú Unibanco paid R$21.5 billion in dividends and interest on capital, resulting in a payout ratio of 60.3% and a yield of 3.2%—not exactly eye-catching compared to a 10-year treasury yield of 4.4%.

The silver lining is that another extraordinary dividend is expected to be announced in 2024. According to the bank’s board of directors, the minimum required Common Equity Tier 1 (CET1) capital, which represents the highest quality capital, is set at 12%. Itaú ended 2023 with a CET1 ratio of 13.7% and the first quarter of 2024 at 13%, even after accounting for extraordinary dividends. This represents a considerable cushion above the minimum requirement.

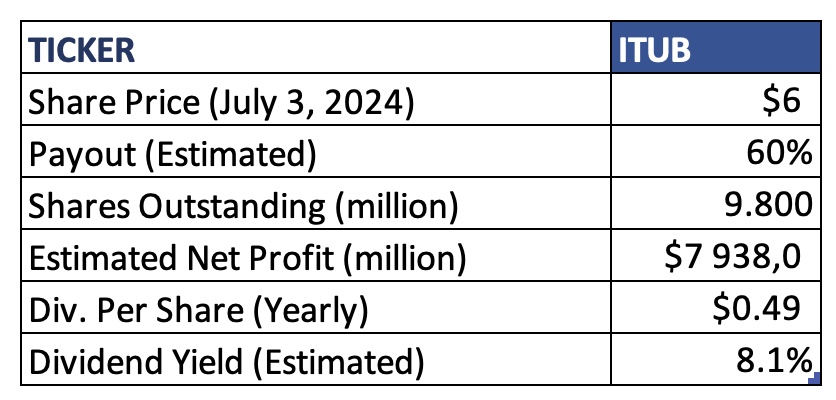

So, if we see a payout similar to 2023, this could lead to a yield of around 8%, especially with estimates pointing to an EPS of $0.81, which represents a 12.5% increase in the bottom line for 2024.

Is ITUB Stock a Buy, According to Analysts?

Only one analyst on Wall Street has covered ITUB stock in the last three months, and he’s bullish, giving it a Moderate Buy consensus rating. Jorge Kui from Morgan Stanley (NYSE:MS) has set an $8 per share price target on ITUB stock, suggesting upside potential of 39.62%.

Kui believes that Itaú’s shares are trading at attractive price-to-book and price-to-earnings multiples, given its strong return on equity and earnings growth projections.

Conclusion

Itaú Unibanco stands out for its longstanding reputation of efficiency and dominant position with high-quality assets in its market segments. This enables it to maintain a robust ROE, which is above average for private banks in Brazil, justifying its premium valuation. I believe that Itaú could be an intriguing addition to an income-focused portfolio in 2024, potentially offering a much more attractive yield than in 2023.

Questions or Comments about the article? Write to editor@tipranks.com