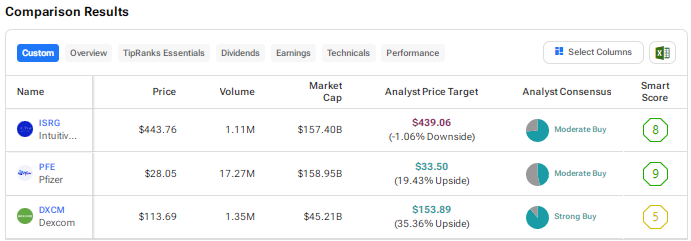

Focus on healthcare has increased since the COVID-19 pandemic caused massive disruptions. Several healthcare companies are expected to benefit from the increased budgets allocated by many countries towards drug development and healthcare infrastructure. Moreover, healthcare companies are leveraging advanced technologies, including artificial intelligence (AI), to address unmet medical needs. Using TipRanks Stock Comparison Tool, we placed Intuitive Surgical (NASDAQ:IRSG), Pfizer (NYSE:PFE), and Dexcom (NASDAQ:DXCM) against each other to pick the healthcare stock that can offer the highest upside potential, according to analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Intuitive Surgical (NASDAQ:ISRG)

Intuitive Surgical is a dominant player in the minimally invasive and robotic-assisted surgery space. The company is mainly known for its da Vinci Surgical System. It placed 313 da Vinci Surgical Systems in the first quarter, ending the quarter with a 14% rise in the installed base to 8,887 systems.

The growth in da Vinci procedure volumes and an expanded installed base of systems drove an 11% rise in the first quarter revenue. Interestingly, higher procedure volumes benefit sales of ISRG’s instruments and accessories. In the first quarter, instruments and accessories revenue accounted for more than 61% of the company’s overall revenue.

Looking ahead, Intuitive Surgical is proceeding with the “measured launch” of its da Vinci 5 model and other new platforms by region. However, management cautioned that da Vinci 5 system placements might be uneven this year due to constrained supply.

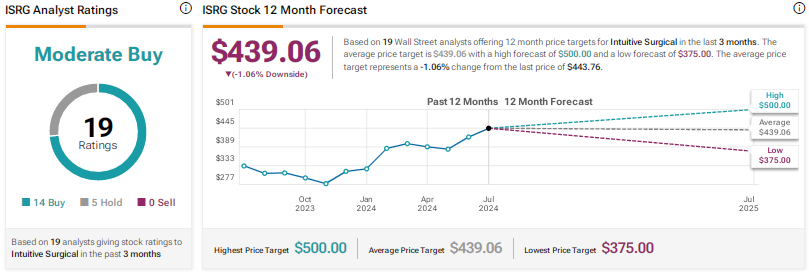

Is Intuitive Surgical a Buy or Sell?

Recently, BTIG analyst Ryan Zimmerman boosted the price target for Intuitive Surgical to $451 from $421 and reaffirmed a Buy rating on the stock following the Society of Robotic Surgery annual meeting. The analyst contends that despite rising competition, robotics continues to be one of the most compelling investment areas in the MedTech space due to the potential to expand beyond the current addressable market.

Zimmerman sees Intuitive Surgical as the clear leader in the robotics MedTech space, thanks to the growing number of systems sold commercially or those in development.

With 14 Buys and five Holds, Intuitive Surgical stock scores a Moderate Buy consensus rating on TipRanks. The average ISRG stock price target of $439.06 implies a possible downside of 1% from current levels. ISRG shares have rallied more than 31% so far this year.

Pfizer (NYSE:PFE)

Pfizer stock has lost its mojo as the plunge in demand for its COVID products has weighed on investor sentiment. The stock witnessed a solid rally during the pandemic due to robust sales of its COVID-19 vaccines and antiviral pill Paxlovid.

To mitigate the impact of the ongoing pressures, Pfizer has been aggressively cutting costs and trying to revive its business with non-COVID product sales. These efforts helped the healthcare giant deliver better-than-expected first-quarter results and raise its full-year earnings outlook. The company recently announced that it is targeting another $1.5 billion in cost savings by the end of 2027, in addition to the $4 billion target announced last year.

Pfizer is now trying to boost its business in growth areas like oncology. Last year, it acquired cancer drugmaker Seagen for $43 billion. The acquisition bolstered PFE’s oncology pipeline, with the company expecting to produce at least eight blockbuster drugs by 2030.

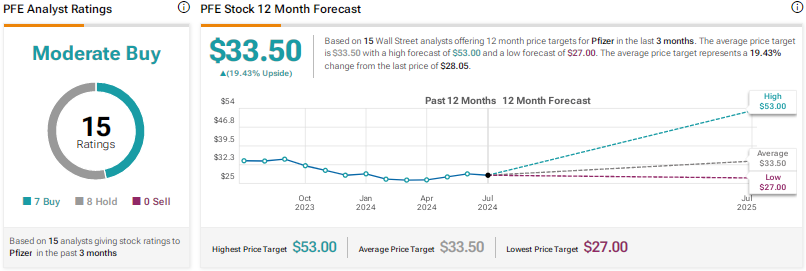

Is PFE a Good Stock to Buy?

With seven Buys and eight Holds, Pfizer stock has a Moderate Buy consensus rating on TipRanks. The average PFE stock price target of $33.50 implies 19.4% upside potential. Pfizer shares are down about 3% year-to-date. Also, PFE offers a dividend yield of about 6%.

DexCom (NASDAQ:DXCM)

DexCom is one of the prominent players in diabetes care. The company has rapidly grown in the diabetes space, fueled by the adoption of its real-time continuous glucose monitoring (CGM) systems.

Dexcom beat first-quarter estimates and raised the lower limit of its full-year sales guidance. Revenue increased 24% to $921 million, with both U.S. and international revenue rising 24%. Adjusted EPS jumped to $0.32 from $0.17 in the prior-year quarter.

However, shares fell after the results were announced, as the midpoint of the full-year sales outlook fell short of the Street’s expectations. Moreover, investors have been concerned about growing competition in diabetes care and the potential impact of weight loss drugs on the demand for CGM devices.

Looking ahead, Dexcom is optimistic about continued sales momentum supported by the launch of new products. It is worth noting that in Q1 2024, DXCM received the U.S. FDA’s (Food and Drug Administration) clearance for its new CGM system, Stelo, which is designed for people with type 2 diabetes who are not on insulin. The company also launched its next-generation Dexcom ONE+ real-time CGM in eight European countries.

Is DexCom a Good Stock to Buy?

Earlier this month, Dexcom stock declined after investors interpreted management’s comments about U.S. sales realignment as an indication that the company’s Q2 revenue might be below expectations.

Bernstein analyst Lee Hambright sees the selloff as a buying opportunity. Based on a discussion with management, the analyst does not believe that they intended to signal anything about the second-quarter performance.

In fact, management reminded the analyst that the projected 12% sequential growth in Q2 global revenue is in line with consensus considering seasonality and the anticipated disruption from the sales realignment.

Including Hambright, 16 analysts have a Buy rating on Dexcom stock while two have a Hold recommendation. Overall, the stock has a Strong Buy consensus rating. The average DXCM stock price target of $153.89 implies 35.4% upside potential. Shares are down 8.4% year-to-date.

Conclusion

Wall Street is more bullish on Dexcom than Intuitive Surgical and Pfizer. They see higher upside potential in DXCM stock compared to the other two healthcare stocks. With continued innovation, Dexcom is well positioned to capture the massive demand for diabetes care products.