With a year-to-date drop of about 33%, Tesla (NASDAQ:TSLA) stands as one of the worst-performing S&P 500 (SPX) stocks. Further, the electric vehicle (EV) giant’s weaker-than-expected Q1 delivery numbers suggest a potential slowdown in demand and an increase in inventory. As a result, this is expected to increase pricing pressures and negatively impact TSLA’s margins, and is unlikely to ease investors’ concerns. In summary, Tesla could emerge as one of the weakest S&P 500 stocks in 2024.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

With this background, let’s look at analysts’ take on Tesla stock following Q1 delivery numbers.

Analysts Weigh In

Tesla’s lower-than-expected Q1 deliveries led to a flurry of opinions among analysts. Joseph Spak from UBS emphasized that Tesla’s Q1 deliveries significantly missed estimates despite lowered expectations. This underperformance is unlikely to alleviate investor worries and further dampen market sentiment. Spak has a Hold rating on TSLA stock with a price target of $165.

Bernstein analyst Toni Sacconaghi’s stance is even more pessimistic. Sacconaghi has a Sell rating on TSLA stock, while his price target of $120 implies about 28% downside potential from current levels. The analyst termed TSLA’s Q1 delivery miss as “brutal.” He added that the numbers indicate demand issues rather than just production hiccups. The analyst believes that the increase in inventory will be a significant headwind for TSLA’s free cash flow.

Meanwhile, Barclays analyst Dan Levy sees inventory building as a concern and expects it to exert pricing pressure on TSLA. Levy expects Tesla’s volume to stay flat in 2024. Further, Wedbush analyst Daniel Ives, who is bullish about TSLA stock, characterized Tesla’s Q1 performance as an “unmitigated disaster” that is difficult to justify. Ives considers this period a pivotal for CEO Elon Musk, who must either turn around the company or face more challenging times.

Is Tesla a Buy, Sell, or Hold?

Lower deliveries, weak demand, and pressure on margins suggest that Tesla’s earnings are set to decline. This could restrict the recovery in TSLA stock. Given these headwinds, Wall Street is sidelined on Tesla stock.

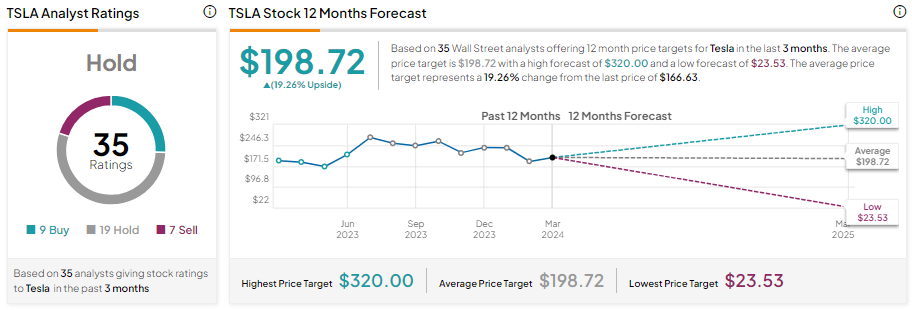

Tesla has nine Buys, 19 Holds, and seven Sell recommendations for a Hold consensus rating. Analysts’ average TSLA price target of $198.72 implies 19.26% upside potential.