The stock of tobacco giant Philip Morris International (PM) has surged over the past 12 months due largely to strong financial results and accelerating sales of its non-smoke products. Personally I’m a little unsure about the stock given its expensive price-to-earnings (P/E) ratio and uncertainly about the future of tobacco products and non-smoke alternatives. For these reasons, I’m Neutral on PM stock.

Philip Morris is More than Marlboro

My Neutral stance is due partly to the changing nature of Philip Morris’ business. The company is now primarily focused on the development of smoke-free products. Headquartered in Stamford, Connecticut, Philip Morris is a giant within the tobacco industry, operating in more than 180 markets worldwide and with a workforce of 82,700 employees.

The company is best known for its flagship Marlboro cigarettes, which once sponsored some of the biggest names in sport and motor racing. But it is increasingly shifting its strategy towards reducing the harm associated with smoking. Phillip Morris aims to replace traditional cigarettes with smoke-free alternatives such as heated tobacco and nicotine pouches. This transformation is driven by a commitment to innovation and an understanding that regulatory changes could impact its legacy business.

The company has invested over $12.5 billion in smoke-free products, and has expanded its portfolio through acquisitions, including Swedish Match. As of 2023, approximately 39% of Phillip Morris’ revenue came from smoke-free products, with a goal of increasing this to over two-thirds (67%) by 2030.

Philip Morris Results Surprise

The shift in strategy appears to be paying off, though not enough to move me off my Neutral view. Philip Morris’ strong Q3 2024 earnings have pushed its stock higher, trading at $130 per share at the time of writing. The company exceeded expectations on both revenue and earnings, with impressive growth across its product lines.

Revenue increased by 8.4% year-over-year to $9.91 billion, with organic revenue growth of 11.6%. This performance was driven by a 2.9% increase in total shipment volume, reaching 203 billion units. Earnings per share (EPS) came in at $1.91, beating the consensus estimate of $1.56. The company’s smoke-free products, particularly IQOS and ZYN, were key drivers of this growth.

The smoke-free business accounted for 38% of total revenues and 40% of gross profit. In Europe, heated tobacco unit (HTU) sales volume grew 11.3%, reflecting strong momentum. All of this led Philip Morris to raise its full-year guidance, projecting EPS of $6.45 to $6.51, up from the previous range of $6.33 to $6.45. This outlook, combined with the strong quarterly results, has boosted investor confidence and driven the stock higher.

A Future Beyond Tobacco?

Despite these successes, I’ve always been skeptical about the future of tobacco, and that’s probably because I’ve never seen the appeal of smoking or these non-smoke alternatives. I believe tobacco is inherently risky given the potential for regulatory changes, and I’m not sure I see the long-term potential in non-smoke products. However, the market appears confident in the company’s long-term potential.

Philip Morris is also evolving into a broader lifestyle, consumer wellness, and healthcare company. Strategic acquisitions and investments support this new direction. Philip Morris purchased Vectura, a British company that produces inhalers for respiratory diseases, and invested in Medicago, which developed a Covid-19 vaccine. Philip Morris has also invested in the legal cannabis industry.

Despite these investments and the aforementioned growth of IQOS and ZYN, as of 2023, about 63% of Philip Morris’ revenue still comes from conventional tobacco products. Further diversification and future success may require additional investments.

PM Stock isn’t Cheap

I’m also Neutral on PM stock because of its pricey valuation. The company’s shares are not cheap. The company is currently trading at 20 times forward earnings, representing a 12.7% premium to the consumer staples segment. This is also a big premium to competitor British American Tobacco (BTI), which trades at just 7.5 times earnings.

British American Tobacco also offers a larger dividend that yields 8.3% versus Philip Morris’s 4.04% dividend yield. The current growth forecasts suggest that British American Tobacco is trading with a price-to-earnings-to-growth (PEG) ratio around three times while Philip Morris’s PEG ratio stands at 1.8. Still, I’m not entirely convinced that Philip Morris is great value for money.

Is Philip Morris Stock a Buy?

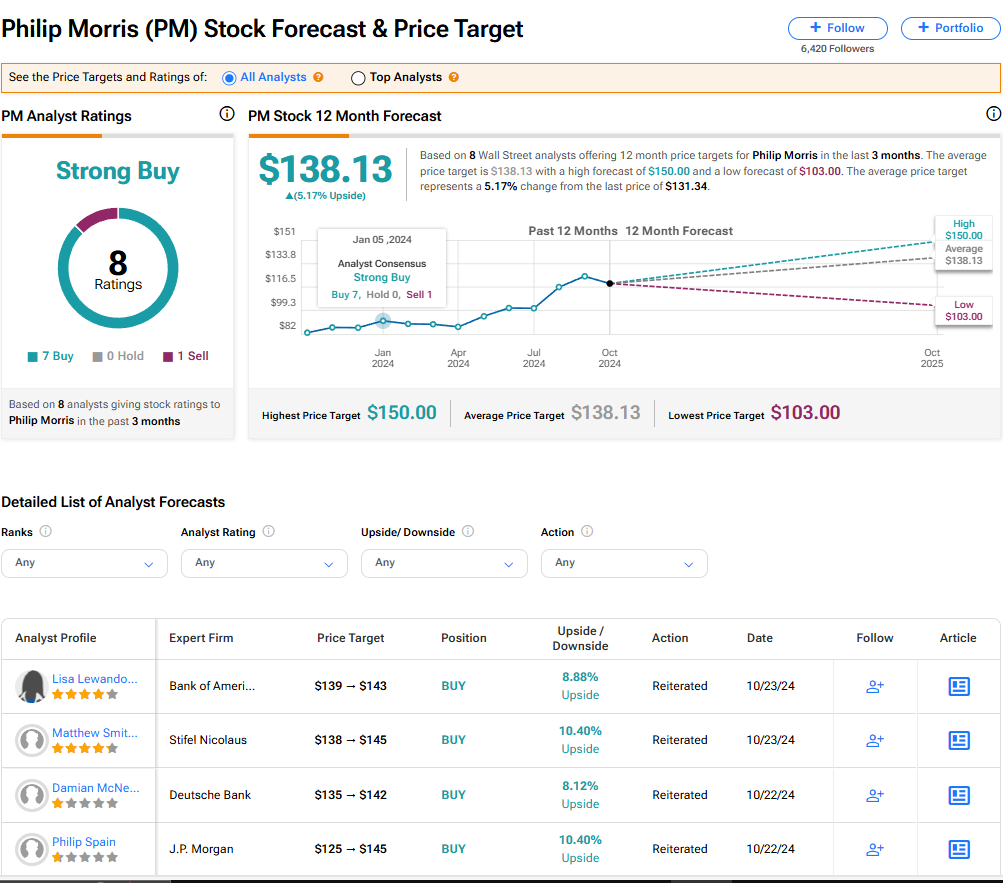

Philip Morris stock has a consensus Strong Buy recommendation based on seven Buy, zero Hold, and one Sell ratings assigned by analysts in the past three months. The average PM price target of $138.13 implies 5.8% upside potential.

Read more analyst ratings on PM stock

The Bottom Line on PM Stock

Philip Morris stock has certainly rewarded investors over the past 12 months. However, I’m not convinced by the long-term prospects of a company that derives the majority of its revenue from tobacco products, and I don’t see the long-term value of smoke-free products. Moreover, I think the stock is expensive compared to its peers despite analysts having a strong growth forecast. As such, I remain Neutral on PM stock.