Palantir Technologies (PLTR) stock has rallied over 240% so far this year, making it an overvalued stock, according to Argus Research. Five-star analyst Joseph Bonner from Argus downgraded the rating for PLTR stock to a Hold from Buy over concerns about its lofty valuations. Meanwhile, PLTR shares were up 3.8% in pre-market trading as of writing.

Palantir shares have gained over 40% since the company delivered a healthy Q3 FY24 beat on November 4. Analysts have been reconsidering their views on the stock. Jefferies analyst Brent Thill downgraded PLTR stock to Sell from Hold, casting doubt on the company’s future growth prospects.

Insights into Bonner’s Changing Views on PLTR

Bonner noted that Palantir shares have nearly tripled in the past year, fast outpacing its underlying fundamentals. That said, the analyst acknowledges that Palantir’s profitability and cash flow have improved meaningfully during the same time.

Importantly, Bonner noted that Palantir caters to a niche market, where companies requiring highly complex IT solutions rely on its expertise. This dependence on a smaller number of companies makes Palantir’s business unpredictable. The stock market often penalizes companies with high-value tech such as Palantir, Bonner added.

Currently, about 55% of Palantir’s revenues come from government contracts in the U.S. defense and intelligence community. However, the company is trying to capture a larger share of the commercial sector, which is becoming heavily tilted toward data analytics and management solutions in the AI (artificial intelligence) realm.

Analysts expect the commercial segment to become a larger contributor to PLTR’s revenues in the long run. This is one of the reasons why Bonner is bullish on Palantir’s long-term potential, though he prefers to remain on the sidelines currently due to concerns like its elevated valuation.

More About the Five-Star Analyst

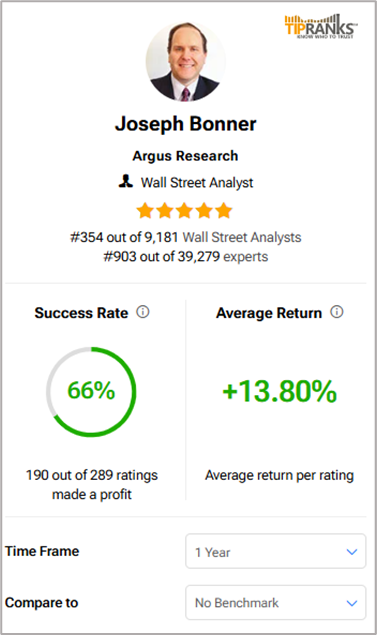

Joseph Bonner ranks #354 of the 9,181 analysts currently ranked on TipRanks. Also, Bonner boasts a success rate of 66% with an average return per rating of 13.80%.

To date, Bonner’s best rating has been his Buy view on HubSpot (HUBS) stock, which earned him an impressive 153.8% return between October 19, 2020 to October 19, 2021.

Is Palantir Stock a Good Buy Now?

Wall Street’s growing concerns over Palantir stock have led to a Hold consensus rating. This is based on three Buys, six Holds, and five Sell recommendations. The average Palantir Technologies price target of $34.30 implies 41.3% downside potential from current levels.