If Elon Musk’s move to detail the financing plan for his Twitter (TWTR) buyout proposal was meant to put pressure on the company’s Board to come to the negotiation table, then the trick appears to have worked. The Board is discussing selling the social media company to Musk, and a deal could be reached as early as April 25, according to a Wall Street Journal report.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Musk offered to acquire Twitter for $43 billion in cash, valuing the company at $54.20 per share. He has secured $46.5 billion in loan and equity financing commitments to pay for the acquisition. Musk has pledged his Tesla (TSLA) shares as collateral for the loan. He may also need to sell some of his shares in Tesla and other businesses such as SpaceX and Boring Company to raise cash for the acquisition. Musk is the CEO of the electric car manufacturer Tesla.

Talks to Focus on Breakup Fee

While Twitter’s board may want to press for a higher buyout price, Musk has insisted that his offer is final. Musk’s aides and Twitter’s Board are expected to discuss a breakup fee, according to the report.

The breakup fee is the amount that Musk would pay to Twitter should the Board agree to sell the company to him, but fail to complete the transaction. The deal may require Twitter shareholders’ and regulators’ approval, without which the transaction may not close. According to Reuters report, Twitter would also need to pay Musk a breakup fee if it accepts a buyout offer from another party.

Wall Street’s Take

The stock has a Hold consensus rating based on four Buys, 23 Holds, and three Sells. The average Twitter price forecast of $45.84 implies 6.3% downside potential from current levels.

Stock Investors

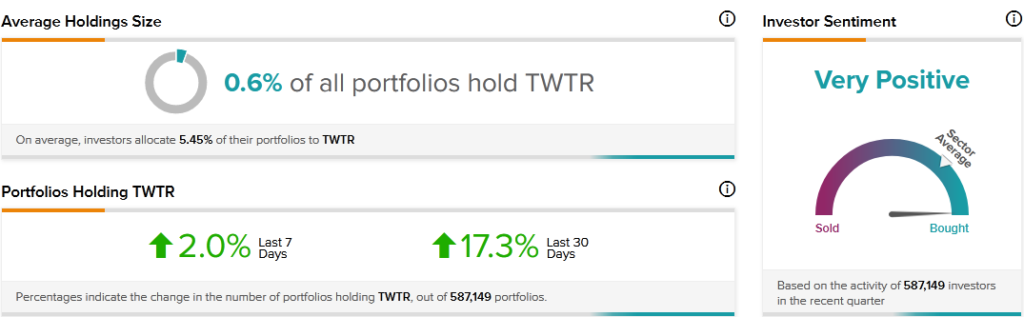

TipRanks’ Stock Investors tool shows that investor sentiment is currently Very Positive on Twitter, with 17.3% of portfolios tracked by TipRanks increasing their exposure to TWTR stock over the past 30 days.

Takeaway for Investors

If Musk succeeds in acquiring Twitter, then the company’s shareholders may walk away with a handsome payout. However, they would miss out on the company’s future success. Musk’s plans include slashing Twitter’s workforce and closing its corporate headquarters, actions that could cut the company’s operating costs. He also suggested steering the company to rely less on advertising sales and more on a subscription business. Such shifts could result in a more profitable Twitter.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Twitter Inks Crypto Payment Deal for Creators

NextEra Energy: Mixed Quarterly Results, Price & Supply Issues Continue

American Express Declines Despite Q1 Beat