There’s no official hall of fame for dividend-paying stocks. If there was one, Johnson & Johnson (JNJ) would arguably be a first-ballot inductee. Having hiked its dividends for 62 consecutive years, the healthcare company is known as a Dividend King. This is a select group of publicly traded companies that have paid higher dividends to shareholders for 50 consecutive years or more.

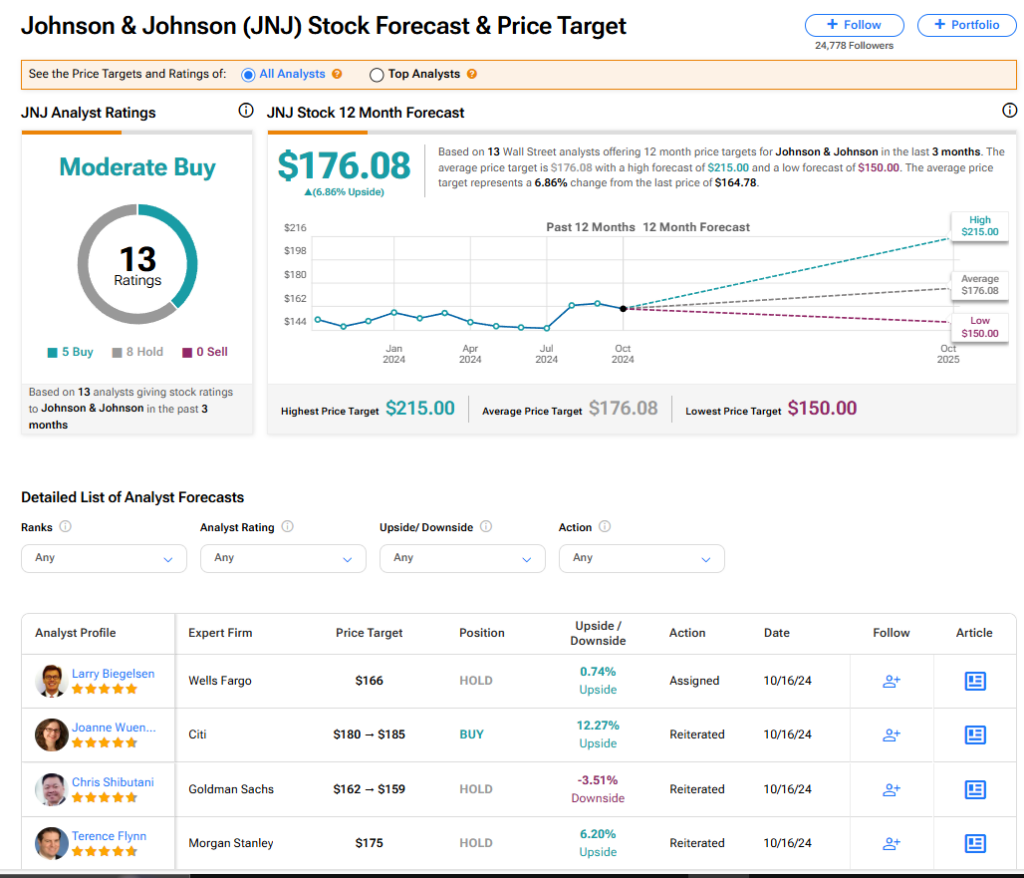

That raises the following question: Is this favorite among dividend investors a buy right now? I think it is and this article will explain why I’m bullish on JNJ stock. Note that Johnson & Johnson’s share price has risen 8% this year, underperforming the benchmark S&P 500 index that is up more than 20% on the year. As the chart below shows, there looks to be a nice entry point in JNJ stock currently.

Q3 Results Were Solid

Strong financial results are one reason to like JNJ stock. The company released its third-quarter financial results on October 15. In Q3, , the company’s reported sales increased by 5.2% from a year ago to $22.5 billion. Johnson & Johnson’s revenue remains robust. The company is a multinational corporation, meaning it has operations throughout the entire world. When reporting financial results, Johnson & Johnson converts sales from native currencies into U.S. dollars.

Because many currencies held up better against the dollar, that negatively impacted the company’s net sales by 1.1% during Q3. Operational sales rose by 6.3%. The Innovative Medicine segment posted $14.6 billion in reported sales during the quarter. For perspective, this was a 4.9% year-over-year growth rate.

CEO Joaquin Duato said that topline growth was powered by 11 key brands delivering double-digit sales growth for the quarter. This was led by multiple myeloma treatment Darzalex, which became the first product in Johnson & Johnson’s portfolio to reach $3 billion in sales in a single quarter. The company’s MedTech segment also put up decent results, with sales increasing 5.8% to $7.9 billion. On the bottom line, the company’s adjusted earnings per share (EPS) fell by 9.4% year-over-year to $2.42.

A Strong Balance Sheet and Sustainable Dividend

Analysts anticipate high single-digit annual growth rates in adjusted EPS at Johnson & Johnson in 2025 and 2026. This is because of new product launches that include the U.S. market launch of the Shockwave E8 peripheral IVL catheter last month. Additionally, Johnson & Johnson has a deep pipeline of new medications and products, with 94 projects currently in various stages of clinical development. Tremfya’s recent launch for ulcerative colitis in the U.S. and planned Crohn’s disease launch in the U.S. could both be big future drivers.

Johnson & Johnson is also a financial fortress. This is backed up by $182 million in net interest income through the first nine months of 2024. Few companies have the balance sheet necessary to generate interest income that exceeds interest expenses. That’s what earns Johnson & Johnson a perfect AAA credit rating from S&P on a stable outlook.

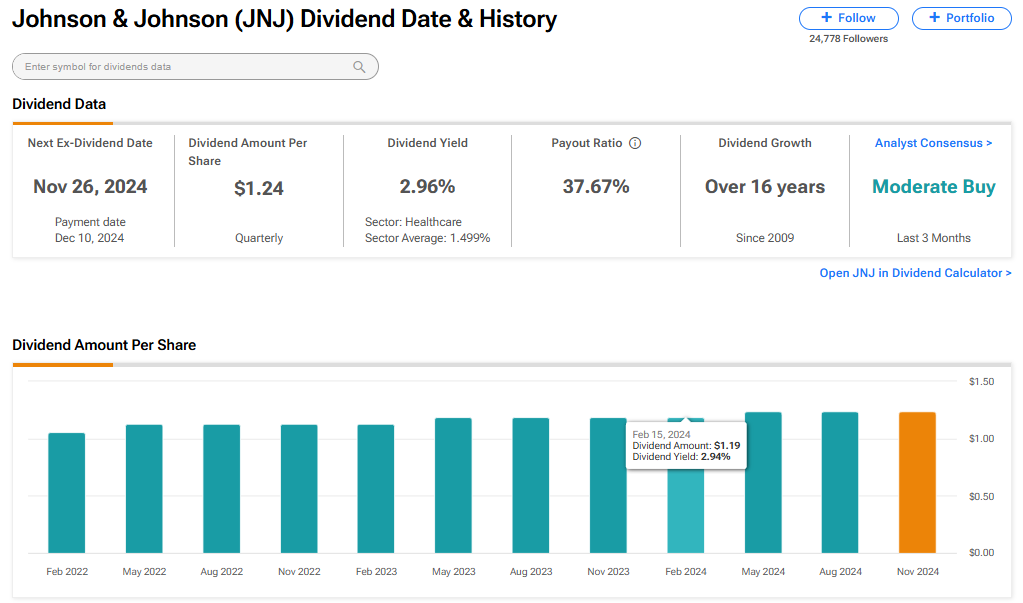

The healthcare company’s 3% dividend yield is also easily covered by its earnings. Johnson & Johnson’s adjusted EPS payout ratio is expected to be a bit below 50% in 2024. That strikes a nice balance between rewarding shareholders and retaining cash for future growth via research and development and acquisitions. The chart below highlights Johnson & Johnson’s dividend payout and growth.

The Valuation Looks Appealing

Johnson & Johnson’s current price-earnings (P/E) ratio of 16.5 is just below its 10-year average of 17.2. The forward P/E ratio based on the 2025 analyst consensus for adjusted diluted EPS is even better at 15.5. For a company with upper single-digit annual earnings growth potential, I think this provides an interesting entry point.

What Does Wall Street Think?

Looking at Wall Street’s opinion on the stock, Johnson & Johnson maintains a Moderate Buy consensus. rating. This is based on five Buy ratings and nine Hold ratings assigned by Wall Street analysts in the past three months. There are currently no Sell recommendations on the stock. At $164.21, the average 12-month price target suggests 6.95% upside potential from current levels.

Read more analyst ratings on JNJ stock

Conclusion

In conclusion, Johnson & Johnson looks set to revive its growth profile via acquisitions and upcoming product launches. Combined with a flawless corporate credit rating, secure dividend payout to shareholders, and discounted valuation, this could pave the way to 10% total returns in the next 12 months. That’s why I remain bullish on JNJ stock.