No matter the general movement of the market since the start of 2023, barring some short periods, you can rest assured Nvidia (NASDAQ:NVDA) stock has been gaining. The stock’s success has been completely in sync with the business’s performance, i.e., the gains have been built on tangible results rather than hype.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Nvidia’s impressive earnings reports have consistently exceeded expectations, expanding both top-line revenue and bottom-line profits. Each report not only promises future growth but also delivers on those promises, creating a positive cycle of investor confidence and continued market interest.

This trend continued in the latest fiscal first-quarter report, where Nvidia once again exceeded expectations. Coupled with an optimistic outlook and the announcement of a 10-for-1 stock split, the stock has surged by 39% since the report’s release.

The nice thing here, according to investor Juxtaposed Ideas, is that the business is so strong, there’s plenty more to look forward to. “With generative AI driving robust sales in both infrastructure and SaaS layers, Nvidia remains well positioned to generate profitable growth and retain leading market share,” the investor said.

We are now in the early innings of the AI boom, with the initial explosion now being positively felt by the “SaaS layer” with other companies enjoying the spoils as well. Meanwhile, Nvidia has completely cornered the market for AI chips, holding a 95% share, with Juxtaposed believing the company remains “well positioned to retain its AI leadership and robust top/ bottom-line performance ahead.”

On the other hand, given the huge share gains (already up by 166% year-to-date), there are some issues to consider. “Potential redundancy/ bullwhip effect, expensive ASPs/ intensified in-house AI chip developments, and tougher YoY comparisons may lead to its near-term correction,” says Juxtaposed.

So, what should investors do now? Juxtaposed thinks for those wanting to scratch the itch and load up, given the market might be over exuberant and there’s the likelihood Nvidia will be facing some tricky y/y comps ahead, it may be “more prudent to wait for a moderate retracement before adding.”

“However,” the investor goes on to say, “we do not believe in timing the market for Nvidia Corporation, with the robust growth prospects warranting a Buy and Hold status in every growth-oriented investor’s portfolio.”

To this end, Juxtaposed Ideas rates NVDA shares a Buy. (To watch Juxtaposed Ideas’ track record, click here)

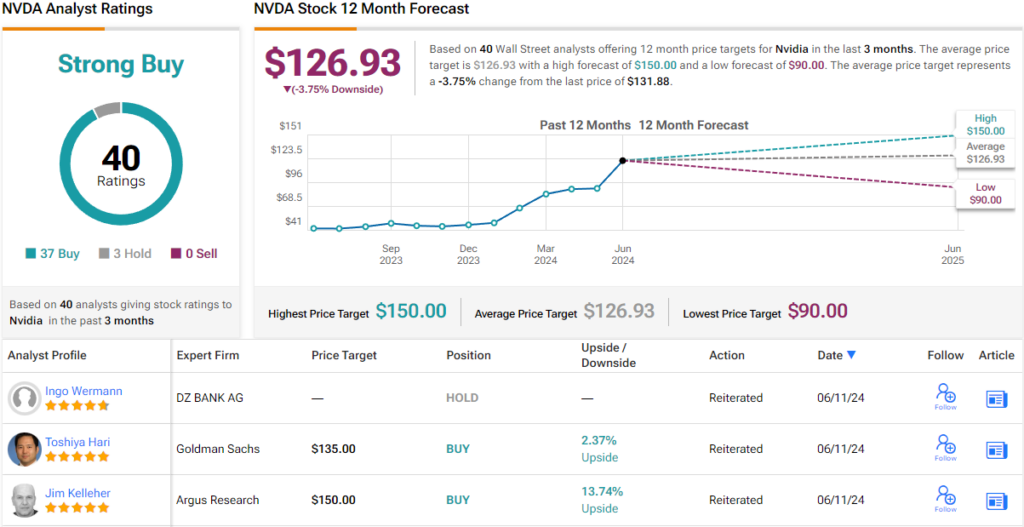

That is also the most common view from Wall Street’s analyst community. Based on 37 Buys against 3 Holds, the stock claims a Strong Buy consensus rating. That said, somewhat paradoxically, the $126.32 average target factors in a one-year decline of 4%, indicating that most analysts also think a breather might be due for this winning stock. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.