Shares of Robinhood Markets (HOOD) (7KY) closed 14% higher on Monday following the news of a possible takeover by crypto exchange FTX.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

FTX is one of the biggest exchanges in the crypto space, and according to Bloomberg, it is in internal talks to figure out how to acquire Robinhood.

The development comes after Robinhood, a darling of retail investors amid the meme stock frenzy, saw its shares slump almost 74% over the past year. Talk of a possible deal between the two companies has been gaining momentum ever since it was revealed last month that Emergent Fidelity, which is owned by FTX founder Samuel Bankman-Fried, owns 56.28 million shares of Robinhood. That is a sizable chunk of Robinhood’s around 743.9 million outstanding shares.

In its regulatory filing last month, Emergent Fidelity noted that it does not currently intend to change or influence the control of Robinhood or participate in such a transaction. However, if deemed appropriate in the future, it may act to increase shareholder value through strategic initiatives or operational or management initiatives.

FTX already seems to be on a drive to expand and is seeking a trust charter to provide crypto-trading to consumers in New York. Additionally, according to the WSJ, FTX is also looking to acquire a stake in BlockFi and has already acquired a stake in Voyager Digital.

Although there has been no official word from Robinhood yet, FTX’s CEO has noted that FTX is open to partnering with Robinhood, but there are no active merger and acquisition (M&A) talks between the two companies, according to TechCrunch.

Analysts Join The Chatter

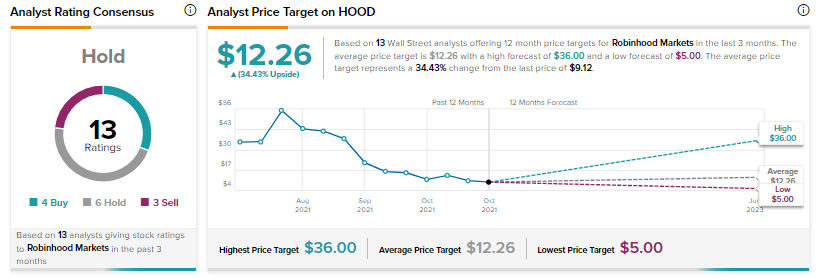

Yesterday, Goldman Sachs’ Will Nance upgraded the stock to a Hold from a Sell but decreased the price target to $9.50 from $11.50. Nance feels fundamentals are still weak for Robinhood and decreasing risk-taking in trading is affecting active users and margin balances.

On the other hand, Mizuho Securities’ Dan Dolev has reiterated a Buy rating on the stock alongside a price target of $14 that indicates a 53.5% potential upside.

The analyst commented yesterday, “We believe that a potential deal would be good news for HOOD as it helps expand its reach and breadth. We also believe that HOOD can survive, and thrive on its own.”

The Street currently has a Hold consensus rating on Robinhood with a $12.26 price target, implying a 34.43% potential upside.

What Do Website Visits Indicate?

Our data crunch at TipRanks reveals that the total number of visits to Robinhood has been on a decline since May 2021 and rose only briefly in November 2021, when cryptocurrencies saw their sharpest increase and the possibility of a Russia-Ukraine conflict was virtually non-existent.

Significantly, this decrease in website traffic from a peak of 30.23 million in May 2021 to 9.73 million in May 2022 has been a leading indicator of the concurrent share price decline for the stock.

Closing Note

After a sharp decline so far in 2022, Robinhood shares are finally seeing major gains, and the next moves by FTX are sure to keep investors hooked.

Read full Disclosure