Cameco (CCJ), a leading nuclear stock, has been on fire this year, surging 39% in 2024 compared to the S&P 500’s (SPX) gain of 23%. The key driver behind this rally is the improving sentiment surrounding the nuclear sector, spurred by major tech companies investing in clean energy solutions. That includes Microsoft’s (MSFT) 20-year power deal with Constellation Energy (CEG) to restart the Three Mile Island nuclear plant and Google’s (GOOGL) purchase of small modular reactors from Kairos Power. This highlights the growing demand for nuclear energy to power AI-driven data centers.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Looking ahead, I believe more gains could be in store for Cameco as nuclear energy continues to play a pivotal role in meeting the rising energy demands of the AI revolution. Thus, I’m initiating coverage with a Buy rating.

CCJ Reports Topline and Bottomline Growth in Q2

Cameco’s second-quarter results shared on July 31 reflect a business with vigorous fundamentals. The company’s revenue surged 20% higher year-over-year to $433.4 million during the second quarter. This topline growth was powered by double-digit sales volume growth (13%) in the Uranium segment to 6.2 million pounds delivered in the second quarter. Healthy uranium demand and constrained supply contributed to a 14% uptick in the average realized price to $56.43 a pound for the quarter.

Cameco’s adjusted net EPS swung from -$0.01 in the year-ago period to $0.10 in the second quarter. A higher revenue base and careful cost management helped make this shift possible for the quarter.

In the years to come, the future appears to be exceedingly bright for Cameco. As nuclear energy continues to receive more interest, volumes should keep rising over time. Greater attention to nuclear power also means that average realized prices should increase, too. The analyst consensus is that the company will generate $0.62 in adjusted net EPS in 2024. For perspective, that would be a 6.5% growth rate over the 2023 base of $0.58. In 2025, the analyst consensus is for adjusted net EPS to nearly double to $1.20. For 2026, another 30.5% growth to $1.56 is being predicted.

Long-term Trends Bode Well for Cameco

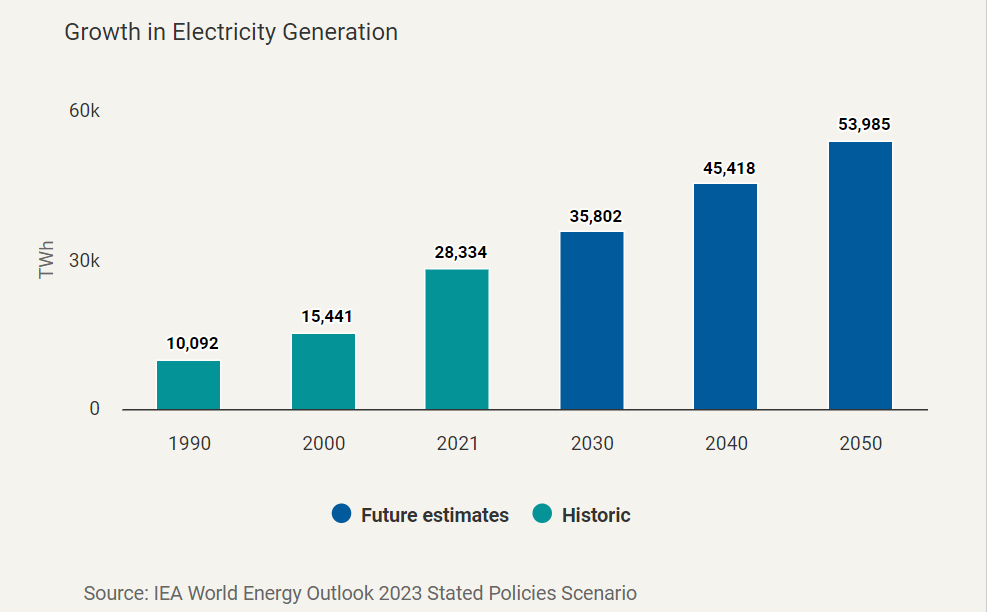

Cameco isn’t just positioned admirably for the near future, either. The same elements that have led to growing uranium demand in recent years seem likely to persist beyond just the next few years. This is because of the macro picture of population growth and economic development. As a result, the International Energy Agency (IEA) projects that total global electricity demand is expected to nearly double from 28.3 TWh in 2021 to 54.0 TWh by 2050.

That significant growth in electricity demand is going to require an all of-the-above approach to energy. Renewables currently can’t and likely won’t be enough to meet all the demand growth in the coming decades. So, this means nuclear will play an important role in electric generation for decades to come.

That’s especially true because the energy source is carbon-free, which can help it achieve global decarbonization goals. Not to mention that nuclear energy is also already economically viable on a large scale. Therefore, it shouldn’t be a surprise that there are currently 441 reactors operating globally and 59 under construction.

Additionally, Cameco can benefit from its 49% stake in the nuclear service and maintenance company, Westinghouse Electric. As plans for additional nuclear plants progress, this business will play a crucial role in assisting utilities with the design, maintenance, and servicing of these facilities.

The Company Is Financially Healthy

Cameco’s appeal doesn’t end with its encouraging near- and long-term growth forecasts. In my view, the company’s financial positioning is another positive.

As of June 30, Cameco maintained a $362 million cash position against $1.4 billion in total debt. The company also has a $1 billion undrawn credit facility maturing on October 1, 2027. This access to liquidity coupled with the long-term nature of its contracts (the contract portfolio spans more than a decade) explains the BBB- credit rating from S&P Global (SPGI), thanks to its stable outlook.

Is Cameco Stock a Buy, According to Analysts?

Viewing Wall Street’s opinion on the stock, Cameco maintains a Strong Buy consensus. That comes from six Buy ratings and no Hold or Sell ratings assigned to Cameco stock in the last 90 days. At $57.25, the average 12-month stock price target implies a 5.86% upside.

Investment Summary

Cameco is well-positioned for continued growth in the nuclear sector, evidenced by its impressive 39% surge in 2024 and robust second-quarter performance. The company’s strong fundamentals are supported by increasing uranium demand, strategic investments from major tech firms, and favorable long-term trends in global energy needs.

Additionally, Cameco’s solid financial health with a significant cash position underscores its stability and resilience. Given these factors, I maintain a bullish outlook on Cameco, initiating coverage with a Buy rating.