Cannabis sales in Canada have been on a rise since May following a decline in April. As per Statistics Canada, sales of legal adult-use cannabis in Canada grew by 5.2% month-over-month to C$244.9 million in August. Cannabis is legal in Canada for both medical and recreational purposes. Moreover, with Cannabis 2.0, cannabis derivative products like edibles, vapes, concentrates, and beverages have also become legal in the country.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

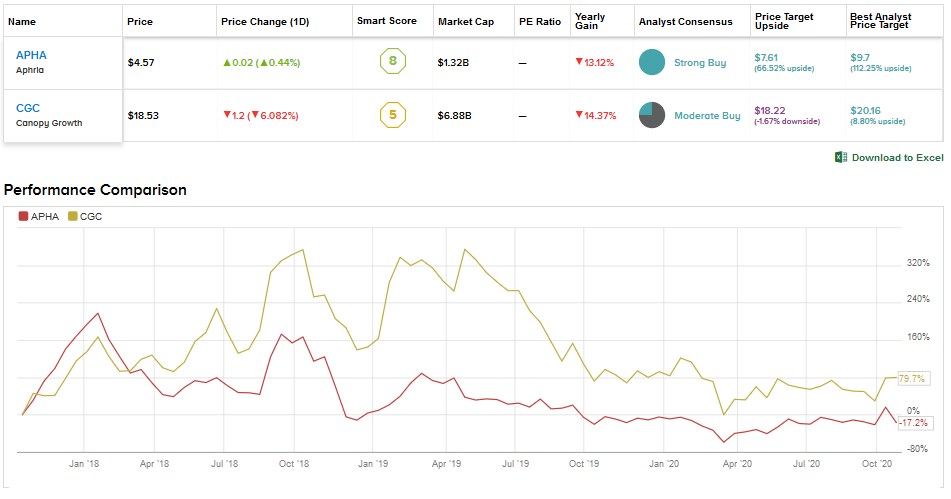

However, intense competition from the illegal market continues to impact the sales of Canadian cannabis companies. Meanwhile, companies are awaiting the legalization of marijuana at the Federal level in the US to capture potential growth opportunities. Against this backdrop, we will use the TipRanks Stock Comparison tool to see if Aphria or Canopy Growth offers a more compelling investment opportunity.

Aphria (APHA)

Ontario-based Aphria sells its medical cannabis products under its namesake brand Aphria and Broken Coast and adult-use or recreational cannabis products under the Solei, RIFF, Good Supply as well as the Broken Coast brands.

Last year, Aphria’s co-founder Vic Neufeld resigned as the CEO of the company amid allegations by short-sellers that the company had overpaid for the acquisition of LATAM Holdings and that insiders had profited from the deal. Vic Neufeld was succeeded by Irwin Simon and under his leadership, Aphria has moved ahead of the controversy and improved its operational performance. It has generated positive adjusted EBITDA for six consecutive quarters unlike its rivals Canopy Growth and Aurora Cannabis, which are still not profitable on an adjusted EBITDA basis.

However, the company’s recently reported 1Q FY21 (ended Aug. 31) results disappointed investors and caused an 18% drop in its shares on Oct. 15. Aphria’s 1Q revenue grew 16% Y/Y to C$145.7 million but was down 4% from the prior quarter due to lower distribution revenue from its German distributor CC Pharma because of the pandemic.

The company’s adjusted EBITDA came in at C$10 million in 1Q FY21, up from C$8.6 million in 4Q FY20 and C$1 million in 1Q FY20. However, investors were concerned as the company slipped into a GAAP net loss per share of C$0.02 in 1Q FY21 compared to EPS of C$0.07 in 1Q FY20. (See APHA stock analysis on TipRanks)

Looking forward, Aphria intends to launch new cannabis 2.0 derivative products, further strengthen its position in the vapes market where it is already the market leader and focus on the newly launched B!NGO brand (a large format, economy brand utilizing lower potency cannabis). It also aims to grow further in international markets by catering to the demand for either GACP (Good Agricultural and Collection Practices) or EU GMP (European Union Good Manufacturing Practices) certified products.

Commenting about the decline in stock following the 1Q results, Haywood analyst Neal Gilmer said, “Investors seemed focused on a drop in the distribution revenue and that the bulk of cannabis growth was due to sell-in of its new value brand. We remain positive on Aphria’s strong market share across its brand portfolio.”

“We continue to view Aphria as the leader in the Canadian LP [Licensed Producer] landscape. We believe yesterday’s 18 per cent correction provides an attractive entry point given Aphria’s strong market share position. We expect the company will continue to demonstrate its leading position, supported by expanding EBITDA margins in fiscal 2021,” added Gilmer in a research note to investors.

Indeed, the Street is very bullish about Aphria and has a Strong Buy consensus based on 7 unanimous Buy ratings. With shares down 12.3% year-to-date, the average analyst price target of $7.61 indicates robust upside potential of 66.5% over the coming months.

Canopy Growth (CGC)

Canopy Growth is one of the largest producers of cannabis and sells its medical and recreational cannabis products through brands like Tweed, Spectrum Therapeutics, Houseplant, DNA Genetics, Tokyo Smoke, Doja, Van der Pop and Maitri. The company’s investors have been concerned about its aggressive investments in production facilities, acquisitions and growth initiatives being a drag on its bottom line. Canopy Growth has not yet posted a positive adjusted EBITDA.

To improve its profitability, the company has been implementing several restructuring initiatives with a focus on reducing costs and cash burn rate. It has also been curbing its capacity at certain plants while shutting down others. Canopy Growth was able to bring down its adjusted EBITDA loss to C$92.2 million in 1Q FY21 (ended Jun. 30) compared to a loss of C$93.4 million in the prior-year quarter.

Meanwhile, 1Q FY21 revenue grew 22% Y/Y to C$110.4 million on strength in the company’s medical cannabis business. However, revenue grew by just 2% Q/Q due to lower Canadian recreational cannabis revenue reflecting the impact of COVID-19 and heightened competition in dried flower-based products.

Canopy sees huge growth opportunities in the derivatives markets, including vapes, chocolates and beverages, and continues to expand its portfolio through innovative products. It has a strong presence in the Canadian cannabis-infused beverage space with a market share of 74% through products like Tweed’s Houndstooth & Soda and Bakerstreet & Ginger. Canopy is now gearing up to launch its beverages in the US market in summer next year through a partnership with Acreage holdings.

Its other strategic initiatives for the US market include the launch of a new e-commerce site shopcanopy.com, expansion of the First & Free brand into topical and creams and further penetration of the BioSteel (Canopy is a major stakeholder in BioSteel) sports beverages.

Last month, Canopy launched Martha Stewart CBD – a new line of hemp-derived wellness supplements (like gummies, softgels and oil drops), which are specially formulated by celebrity Martha Stewart. (See CGC stock analysis on TipRanks)

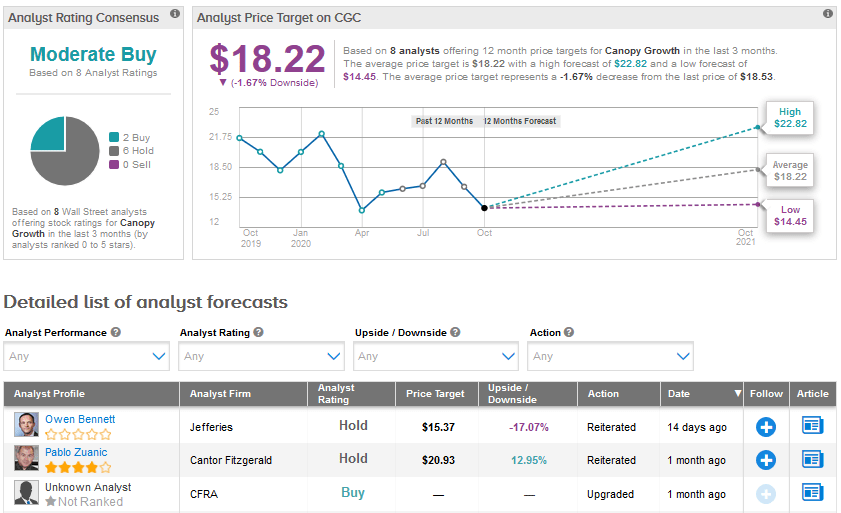

Recently, Cantor Fitzgerald analyst Pablo Zuanic reiterated his Hold rating for Canopy and increased his price target to $20.93 from $20.56. The analyst noted that like its rival Aurora Cannabis, Canopy is also significantly dependent on the flower value segment rather than higher-margin products. As a result, both companies are adversely impacted by price deflation, even at the low end of the price scale.

However, Zuanic feels that Canopy has much more financial flexibility than Aurora and can afford to take more risks. He sees “near-term upside” for Canopy shares based on encouraging market data and expects 24% sequential sales growth for Canopy in 2Q FY21, which is over three times the 7% consensus analyst estimate.

Meanwhile, the Street is cautiously optimistic about Canopy Growth with a Moderate Buy consensus based on 2 Buys versus 6 Holds and no Sells. The $18.22 average analyst price target indicates a possible downside of 1.7% ahead. Shares have already declined 12.2% year-to-date.

Conclusion

Aphria has been consistently delivering positive adjusted EBITDA over the recent quarters while Canopy Growth is still away from that goal. Currently, Aphria appears to be a better cannabis pick than Canopy Growth as reflecting in the Street’s highly bullish stance and upside potential ahead.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment