Biotech firm Ironwood Pharmaceuticals (NASDAQ:IRWD) recently found itself in the limelight, as the shares dropped 38% following the announcement of mixed Phase III trial results on a prospective drug. Despite that, the company has a strong flagship product, projects growth in 2024, and enjoys a bullish outlook from analysts.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts and uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Gut Check

Ironwood Pharmaceuticals is a biotech firm committed to discovering, commercializing, and developing medicinal solutions for treating GI (Gastrointestinal) diseases. Their flagship product, LINZESS, is in its 11th year on the market and is the leading prescription treatment for adults with IBS-C or chronic idiopathic constipation.

Ironwood recently announced results from the pivotal Phase III STARS trial for its drug, Apraglutide. The trial results were seen as significant, marking the first successful Phase III placebo-controlled study in SBS-IF patients (short‐bowel syndrome with intestinal failure) using a GLP-2 analog with once-weekly dosing.

However, the trial did not meet all the goals. While it achieved its primary endpoint and the first two key secondary endpoints, it fell short on the last two secondary endpoints. Ironwood plans to submit a new drug application (NDA) and other regulatory filings for approval despite the setbacks. The company believes the drug can eventually achieve $1 billion in peak net sales if approved.

Recent Performance and Outlook

Ironwood released its Q4 financials, reporting revenue of $117.55 million, slightly surpassing the consensus estimate of $117.48 million. However, Q4 adjusted earnings per share (EPS) came in at $0.00, whereas consensus predictions were for $0.21.

For the full year 2023, Ironwood accumulated a total revenue of $443 million, with a substantial chunk ($430 million) coming from the LINZESS collaboration in the U.S.

Looking forward, Ironwood projects revenue for 2024 in the range of $435 million to $455 million, with adjusted EBITDA expected to exceed the $150 million mark.

Where the Stock Stands Now

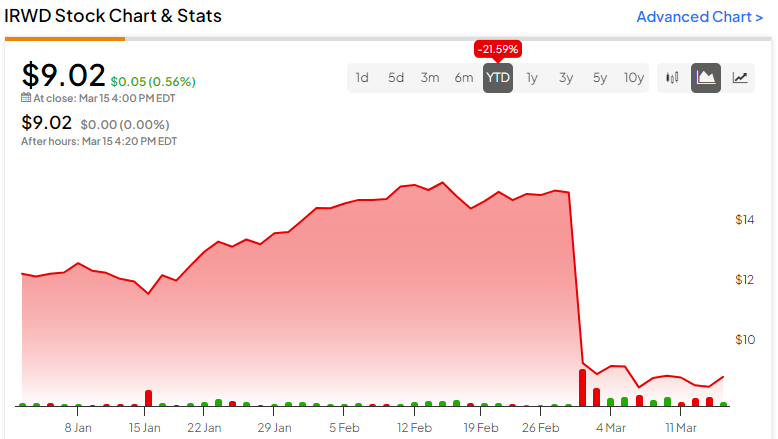

After announcing the Phase III STARS trial results, IRWD stock dropped over 38%. With a recent price of $9.02, IRWD is trading toward the bottom of its 52-week range of $8.07-$15.70. It shows ongoing negative price momentum, trading below the 20-day (10.86) and 50-day (11.90) moving averages.

Despite the recent price decline, Ironwood stock trades in relatively rich valuation territory. Its price-to-sales ratio of 3.5x is above the Healthcare sector average of 2.0x and the Drug Manufacturers – Specialty and Generic industry average of 2.1x.

Is Ironwood Pharmaceuticals a Good Stock to Buy?

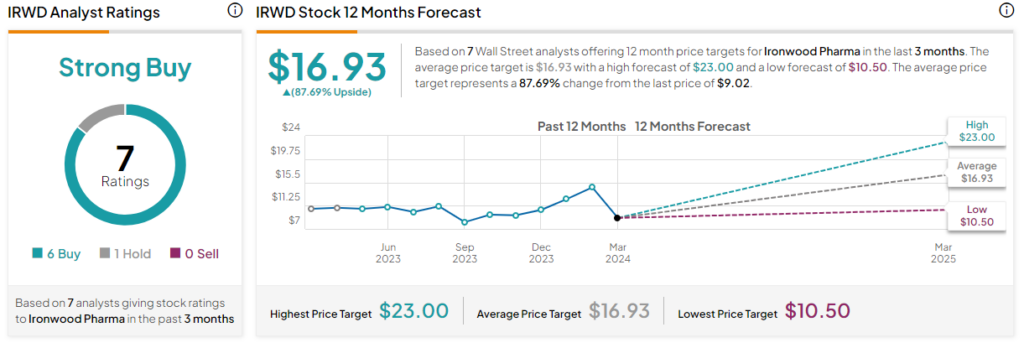

Analysts covering Ironwood Pharma stock have mostly been bullish, though they have adjusted their price targets after the Phase III trial results were announced. For example, Craig-Hallum analyst Chase Knickerbocker lowered the firm’s price target to $18 from $21 while maintaining a Buy rating on the stock. He believes the adverse reaction to Apraglutide’s phase 3 readout is overdone and sees an attractive risk-reward post-data for investors.

IRWD is currently listed as a Strong Buy based on six Buys versus one Hold rating in the past three months. Their average 12-month price target of $16.93 represents an upside potential of 87.69% from current levels.

Closing Thoughts on IRWD

Ironwood’s pursuit of innovative solutions for treating GI diseases has been rather successful thus far, with its flagship product, LINZESS, consistently contributing to its revenue stream. However, the company’s recent Phase III trial results for Apraglutide were mixed, causing a significant stock price drop.

Despite the current negative price momentum and relatively rich valuation, analyst ratings remain mostly bullish, suggesting considerable upside potential. Pharma shares can be quite volatile, as recently demonstrated, so investors should be prepared for the ride if pursuing this growth-oriented stock.