As one of the world’s leaders in mobile technology, Apple (NASDAQ:AAPL) hasn’t exactly been doing well lately. The questions that long dogged the company’s heels about losing its creative spark haven’t gone away. They’ve actually gotten louder in some cases. And today, we see that Apple’s planned solutions aren’t really helping, as Apple is down over 1.5% in Thursday morning’s trading.

Apple took another hit from the analysts today, with Piper Sandler—via analyst Harsh Kumar—cutting Apple’s rating from Overweight to Neutral. A series of concerns went into that rating, starting with a glut of unsold iPhone inventory and ending with, among other things, a sputtering Chinese market and some unpleasant comparisons to previous quarters. Then there’s the matter of high-interest rates, which are also delivering some downward momentum to Apple’s performance. Yet, Kumar left the price target of $205 per share intact.

Apple Has a Fix in Mind…Sort Of

New reports from Ming-Chi Kuo of TF International Securities say Apple is planning an upgrade for the iPhone 17, focused on the camera. The planned 2025 release is set to come with a 24-megapixel front-facing camera that boasts a six-element lens. That’s a huge leap forward from the 12-megapixel camera that the iPhone 14 and iPhone 15 were packing. However, the iPhone 16 will likely carry the same 12-megapixel camera that the iPhone 15 already has. However, there may be an upgrade for the iPhone 16 Pro in the form of a periscope lens.

Is Apple Stock a Buy or Sell?

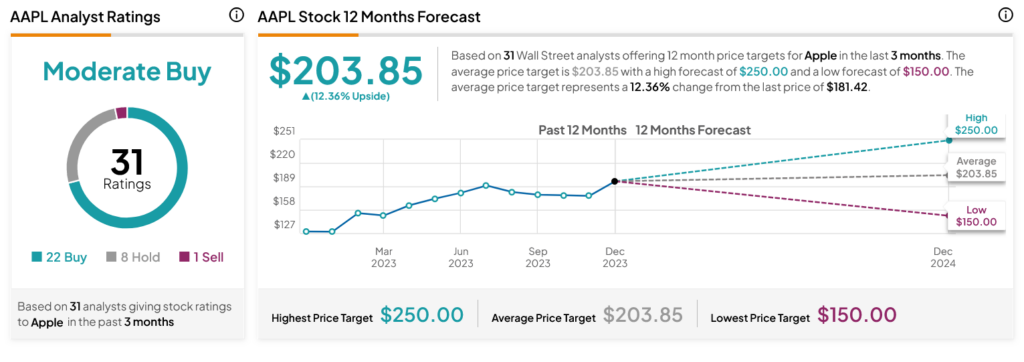

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 22 Buys, eight Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 46.39% rally in its share price over the past year, the average AAPL price target of $203.85 per share implies 12.36% upside potential.