Shares of cloud software provider Samsara (NYSE:IOT) rallied by nearly 12% today after news of the company’s fourth-quarter results impressed investors. Revenue surged by 48% year-over-year to $276.27 million, outpacing estimates by about $17.98 million. In sync, EPS of $0.04 came in better than expectations by $0.01.

During the quarter, annual recurring revenue (ARR) increased by 39% year-over-year to $1.1 billion. Further, its gross margin improved by 300 basis points to 75%. The company’s total number of customers with an ARR of more than $100,000 soared by 49% to 1,848.

Importantly, this was Samsara’s second consecutive quarter with a positive bottom line. For Fiscal Year 2025, the company expects its top line to rise by 27%-28% to a range of $1,186 million to $1,196 million. EPS for the year is anticipated to be between $0.11 and $0.13.

For the upcoming quarter, Samsara anticipates revenue in the range of $271 million to $273 million. This points to a robust 33%-34% growth in its top line. EPS for the quarter is seen landing between $0.0 and $0.01.

Is Samsara a Buy, Sell, or a Hold?

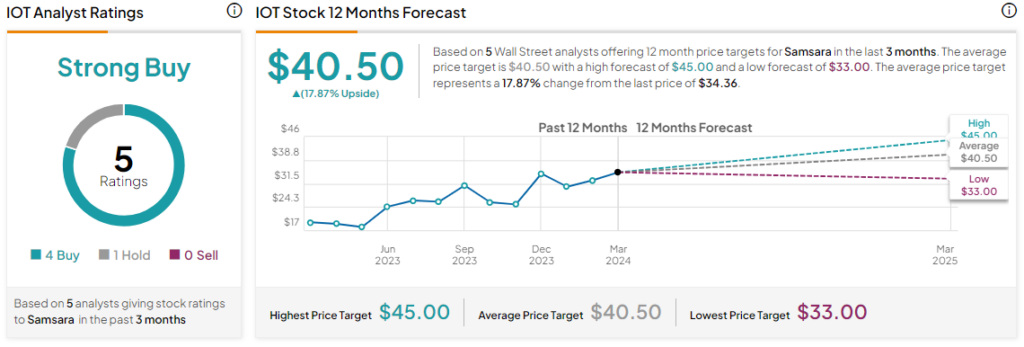

Samsara’s stock price has rallied by nearly 64% over the past year. Overall, the Street has a Strong Buy consensus rating on the stock alongside an average price target of $40.50. However, it’s worth noting that estimates will likely change following today’s earnings report.

Read full Disclosure