Quantum computing company IonQ (IONQ) is making remarkable strides, including recently landing the largest U.S. Quantum contract of 2024 from the Air Force. The company continues to push the boundaries on this cutting-edge technology, having recently surpassed ‘three 9’s’ two-qubit gate fidelity, marking a significant milestone in high-performance quantum computing. These achievements, combined with strategic partnerships with global leaders like SoftBank (SFTBY) and academic institutions like the University of Maryland, position IonQ as an exciting investment prospect with great potential for impactful returns from potentially groundbreaking technology.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

IonQ Is Leading the Qubit Revolution

IonQ is a U.S.-based company that designs, develops, and builds specialized quantum computing hardware systems and provides maintenance, support, and consulting services for co-developing algorithms on advanced quantum computing systems. It also offers access to quantum computers with varying qubit capacities through major cloud platforms like Amazon Web Services (AMZN), Microsoft’s Azure Quantum (MSFT), and Google’s Cloud Marketplace (GOOGL).

The company’s revenue has nearly doubled for the third consecutive year, bolstered by key industry partnerships, such as its multimillion-dollar contract extension with Amazon Web Services (AWS), a $9M deal with the University of Maryland, and a quantum networking contract with the Applied Research Laboratory for Intelligence and Security (ARLIS).

IonQ announced a landmark $54.5 million contract with the United States Air Force Research Lab, marking the most significant quantum contract award in the U.S. for 2024. The company has reported $72.8 million in bookings year-to-date and remains confident in its ability to meet or exceed its annual bookings guidance of $75-95 million.

The company also announced a technical achievement by surpassing “three 9’s” (99.9%) two-qubit gate fidelity on its next-generation barium development platform. Recently, it was featured on Fast Company’s 2023 Next Big Things in Tech List and Deloitte’s 2023 Technology Fast 500 List, highlighting its technological innovation and rapid growth.

What Is the Price Target for IONQ Stock?

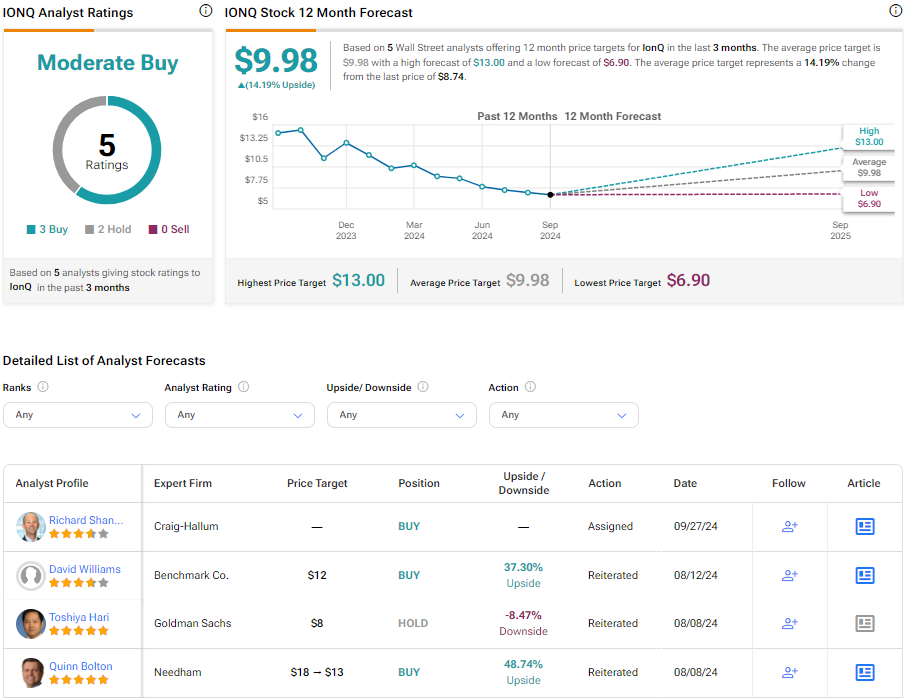

The stock has been highly volatile, with a beta of 3.23. Over the past 90 days, it has jumped up over 40%. Despite this, it trades near the low end of its 52-week price range of $6.22 – $16.60 and shows positive momentum by trading above its 20-day (7.85) and 50-day (7.67) moving averages. The run-up in price has also pushed the P/B ratio to 4.0x, a slight premium to the Computer Hardware industry average of 3.4x.

Analysts covering the company have taken a cautiously optimistic view of IONQ stock. For instance, Benchmark Co. analyst David Williams recently reiterated a Buy rating on the stock with a $12.00 price target, noting the company’s technological progress hitting the triple 9’s and robust financial performance beating recent revenue expectations.

IonQ is rated a Moderate Buy overall, based on five analysts’ recent recommendations and price targets. The average price target for IONQ Stock is $9.98, representing a potential upside of 14.19% from current levels.

Final Insights on IonQ

IonQ’s impressive portfolio of achievements and strategic collaborations set the stage for a potential quantum revolution. The company’s technological advancements have positioned it as a leader in high-performance quantum computing. The company’s revenue growth is equally robust, fueled by crucial partnerships, a lucrative contract with the United States Air Force Research Lab, and a promising bookings forecast. With its innovation-driven growth, market leadership, and solid financial standing, IonQ appears to be a compelling investment prospect in the cutting-edge world of quantum technology.