At the height of the COVID-19 pandemic, biotech companies swiftly responded with innovative solutions in record time. Despite ongoing variants, the demand for treatment is expected to decline at a 20.73% compound annual growth rate through 2028, according to research firm Statista. It’s an interesting time for newcomer Invivyd (NASDAQ:IVVD) to bring its first clinical treatment targeting COVID-19 prevention in immunocompromised patients to market. It may be a case of too little, too late for the company, making the stock a highly speculative play for investors.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

New Treatment Available for At-Risk Group

Invivyd is a clinical-stage biopharmaceutical company engaged in developing and commercializing antibody-based solutions targeting infectious diseases like COVID-19. The company’s primary pivotal offering is PEMGARDA, a preventive solution for COVID-19 for certain adults and adolescents with significant immune compromise, for which it has received an EUA (Emergency Use Authorization).

The EUA, contingent on the ongoing evaluation of the public health emergency by the U.S. Department of Health and Human Services, allows the use of PEMGARDA for specific high-risk populations. However, should the agency deem the emergency use unnecessary, Invivyd would need to halt PEMGARDA marketing in the U.S., potentially causing significant disruption to its operations and financial stability.

Invivyd has identified the need for over 9 million immunocompromised Americans who may not adequately respond to the COVID-19 vaccination and could benefit from products like PEMGARDA.

Invivyd’s Financials & Outlook

Invivyd reported a net loss of $198.6 million for the fiscal year ending December 31, 2023. This represents a significant reduction compared to the net loss of $241.3 million reported at the end of the previous year. The basic and diluted net loss per share correspondingly dropped from $2.23 in 2022 to $1.81 in 2023.

As of December 31, 2023, the company held $200.6 million in cash and cash equivalents. With its current operating plans taken into account and excluding any potential cash collections from PEMGARDA sales, Invivyd projects that its existing cash holdings will cover the company’s operating expenses and capital expenditure requirements up until the fourth quarter of 2024.

Raising capital poses a significant financial risk for the company as it navigates through cash burn in the near future. Options such as an equity offering or debt financing will likely result in a dilution of existing stockholder shares and a potential depression of the stock price.

Is IVVD Stock a Buy, Hold, or Sell?

Invivyd stock is highly volatile, though it has seen significant upward movement since November and is up over 142% in the past six months. It trades toward the higher end of the 52-week price range of $0.98-$5.19 and demonstrates ongoing positive price momentum trading above the 20-day (3.79) and 50-day (3.81) moving averages.

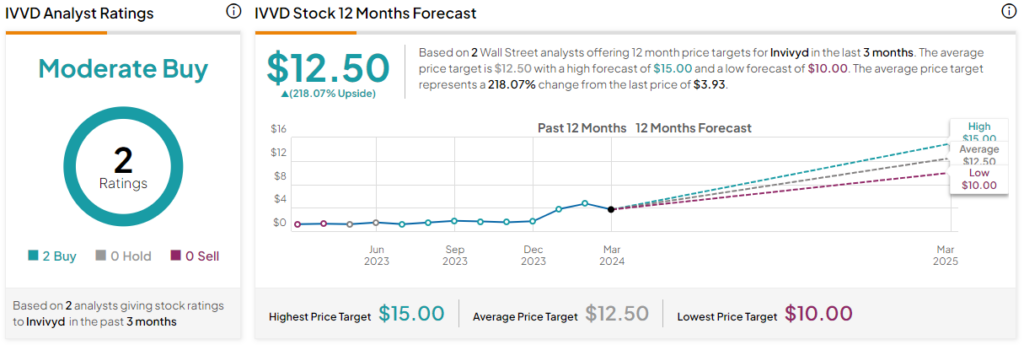

The company is thinly followed by Wall Street, though the two analysts covering it have been bullish on its prospects. For instance, H.C. Wainwright analyst Patrick Trucchio recently reiterated a Buy rating on Invivyd and set a price target of $15.00. He cites the EUA as a significant milestone that suggests a streamlined path to approval and potential future successes with follow-on candidate treatments.

The company is rated a Moderate Buy based on the two analysts’ ratings and 12-month price targets issued in the past three months. The average price target for IVVD stock is $12.50, representing a 218.07% upside from current levels.

Big Picture for IVVD

As the market expects a decline in demand for COVID-19 treatments, Invivyd is swimming against the current by advancing its COVID-19 preventive solution.

While it’s undeniable that the need demonstrated by immunocompromised individuals warrants a treatment solution like PEMGARDA, it remains to be seen whether the HHS (United States Department of Health and Human Services) will sustain its classification as a health emergency and uphold the EUA. Without that, Invivyd could quickly become insolvent, making the stock a highly speculative endeavor.