Leading robotic surgical device maker Intuitive Surgical (NASDAQ:ISRG) posted better-than-expected third-quarter results, driven by a strong rise in procedure volume and higher system revenue. Q3 adjusted earnings per share were flat year-over-year at $1.19 but came ahead of analysts’ consensus of $1.12.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company, which makes the da Vinci surgical systems, also raised its full-year procedure growth guidance to the range of 17% to 18%, up from the prior outlook range of 14% to 16.5%.

ISRG stock surged 11.7% in Tuesday’s extended trading session in reaction to the solid results despite a challenging market. Shares have plunged 46.1% year-to-date (as of October 18).

Intuitive’s third-quarter revenue increased 11% compared to the prior-year quarter to $1.56 billion, topping the Street’s consensus estimate of $1.51 billion. The top-line growth was driven by higher da Vinci procedure volume, partially offset by currency headwinds and lower system placements.

Q3 da Vinci procedure volumes grew by 20%. Procedure growth was mainly driven by the general surgery category, with strength in bariatrics, cholecystectomy, and hernia repair.

Meanwhile, system revenue increased by 3% to $426 million. The company placed 305 da Vinci Surgical Systems in Q3 2022, down from 336 systems in Q3 2021 but better than the 279 in Q2 2022.

The COVID-19 pandemic had significantly impacted sales of the company’s robotics-assisted surgical systems as the focus of hospitals shifted to coronavirus patients. Following the reopening of the economy, Intuitive has been under pressure due to supply chain challenges and high inflation.

Is Intuitive Surgical a Good Stock to Buy?

Following the print, BTIG analyst Ryan Zimmerman reiterated a Buy rating on Intuitive Surgical stock with a price target of $247.

Zimmerman noted, “After multiple quarters of downbeat tone on CapEx, ISRG noted a variety of encouraging metrics against a moderately improving supply backdrop.”

The analyst further added that the company’s profitability is under pressure due to currency headwinds, inflation, and supply chain woes. That said, Intuitive is now expecting lower FY22 operating expense growth in the range of 21% to 23% compared to the prior range of 23% to 25%, more modest capital expenditure, and further leverage in FY23 due to a slowdown in headcount increases.

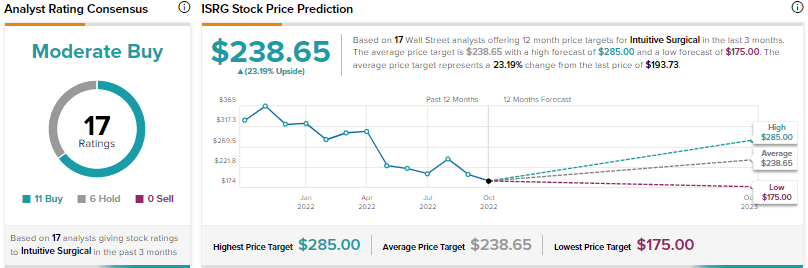

Overall, the Street is cautiously optimistic on Intuitive Surgical stock with a Moderate Buy consensus rating based on 11 Buys and six Holds. The average ISRG stock price target of $238.65 implies 22.2% upside potential.