Medical devices maker Intuitive Surgical (ISRG) is scheduled to announce its third-quarter results on October 17. The company has exceeded analysts’ expectations for six consecutive quarters. Analysts are bullish about ISRG’s prospects and expect continued growth, driven by the demand for the company’s robotic-assisted surgical devices, mainly da Vinci surgical systems.

Analysts’ Expectations from ISRG’s Q3 Results

Intuitive Surgical impressed investors with a 14% growth in its Q2 revenue to $2.01 billion and an over 25% rise in its earnings per share (EPS) to $1.78. The company saw a 14% rise in its da Vinci surgical system installed base to 9,203 systems. Moreover, ISRG’s top line gained from a 17% rise in da Vinci procedures.

Analysts expect the company’s Q3 EPS to grow by more than 12% to $1.64. They project revenue to grow by 15% to $2.01 billion.

Ahead of the Q3 results, Truist analyst Richard Newitter increased the price target for ISRG stock to $570 from $520 and maintained a Buy rating. Regarding the broader MedTech sector, the analyst thinks that companies with elective or deferrable procedure areas could announce more subdued guidance increases due to Hurricane Helene.

Nonetheless, the analyst believes that Intuitive Surgical deserves a premium multiple, given the sustained rise in procedure growth and a new product cycle that has the potential to accelerate revenue and EPS growth.

Likewise, Raymond James analyst Jayson Bedford raised the price target for Intuitive Surgical to $540 from $500 and reaffirmed a Buy rating. Bedford expects accelerating revenue growth over the next two years with the launch of da Vinci 5 and expects da Vinci 5 placements to be better than expectations.

Options Traders Anticipate More than 5% Stock Movement

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. As per the tool, options traders are expecting a 5.54% move in either direction.

Is ISRG Stock a Buy?

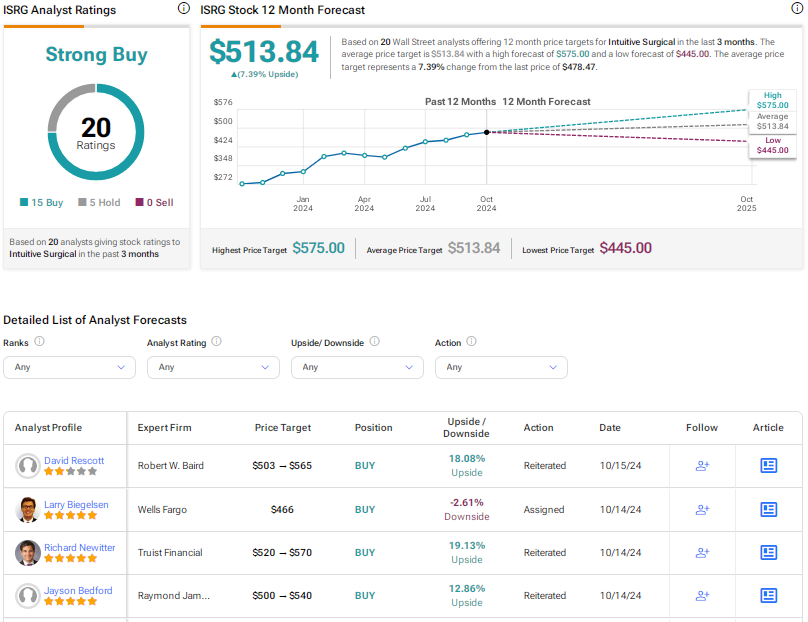

With 15 Buys and five Holds, Intuitive Surgical stock scores a Strong Buy consensus rating on TipRanks. The average ISRG stock price target of $513.84 implies 7.4% upside potential. Shares have rallied about 42% so far this year.