Intuit Inc. updated its 2Q and fiscal 2021 outlook to reflect the completion of the Credit Karma acquisition. The financial accounting and tax preparation software maker had inked a deal in February to buy Credit Karma in a cash and stock deal worth $7.1 billion.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Intuit (INTU) expects Credit Karma to contribute $545-$580 million in revenues and $15-$35 million in operating income during fiscal 2021. Therefore, the company raised fiscal 2021 sales guidance range to $8.810-$8.995 billion from $8.265-$8.415 billion expected earlier.

However, the company lowered its non-GAAP earnings outlook to $8.20-$8.40 per share from the $8.40-$8.55 anticipated previously. (See INTU stock analysis on TipRanks)

For 2Q, Intuit forecasts revenues between $1.935 billion and $1.965 billion, translating into a year-over-year increase of 14%-16%, up from the previous projection of 8%-9% growth. Non-GAAP EPS guidance was lowered to $1.25-$1.31 from $1.31-$1.34 expected earlier.

Last month, Oppenheimer analyst Scott Schneeberger reiterated a Buy rating and the price target of $382 (2.6% upside potential) on the stock. In a note to investors, Schneeberger wrote, “We anticipate Intuit’s strong base business to be augmented by its pending Credit Karma acquisition on the strength/opportunity of the combined companies’ consumer finance platform.”

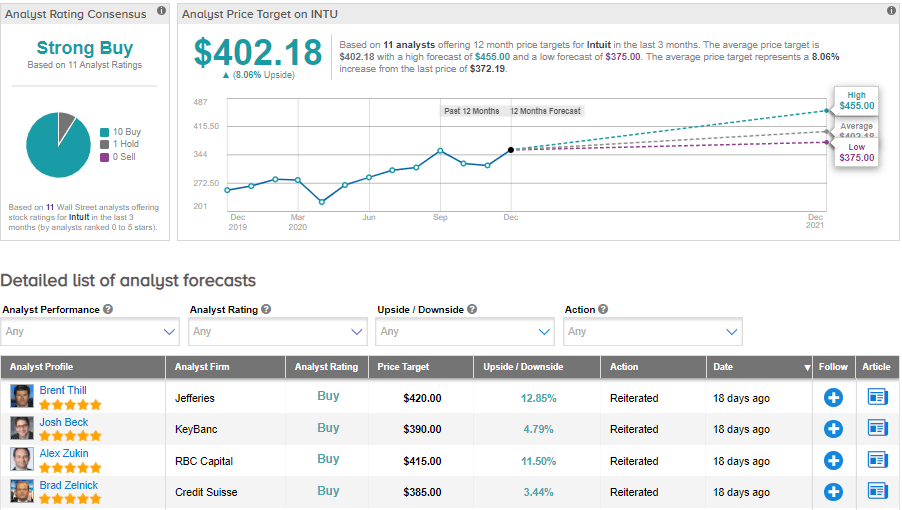

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 10 Buys and 1 Hold. The average price target stands at $402.18 and implies upside potential of about 8.1% to current levels. Shares have increased by 42.1% year-to-date.

Related News:

Perion Pops 14% Pre-Market On Lifted Sales Outlook; Street Sees 35% Upside

Zuora Slips On 4Q Loss Forecast; Needham Sticks To Hold

Yext Sinks 19% As Its 4Q Sales Outlook Disappoints; Analyst Cuts PT