Shares of Inter Parfums slipped 2.2% in Tuesday’s extended market trading after the perfume and cosmetics maker reported lower-than-expected guidance for 2021.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Inter Parfums (IPAR) projects its 2021 sales to be in the range of $610 million – $625 million, missing analysts’ estimates of $669.8 million. Meanwhile, it expects earnings in the range of $1.20 – $1.25 per share compared to the $1.62 per share analysts had been looking for.

The company’s CEO Jean Madar said “After a subdued 2020 in terms of advertising and promotion, we are putting muscle behind our major brands and important launches in 2021. With the expectation of effective, safe and widely distributed Covid-19 vaccines, we look forward to regrowing our sales and restoring the operating leverage inherent in our business model, knowing that the road ahead may have some speed bumps along the way.”

Last month, the company reported 3Q earnings of $0.52, which topped the Street’s estimates of $0.44 per share. Its sales of $160.6 million also beat the analysts’ consensus of $107.8 million. (See IPAR stock analysis on TipRanks).

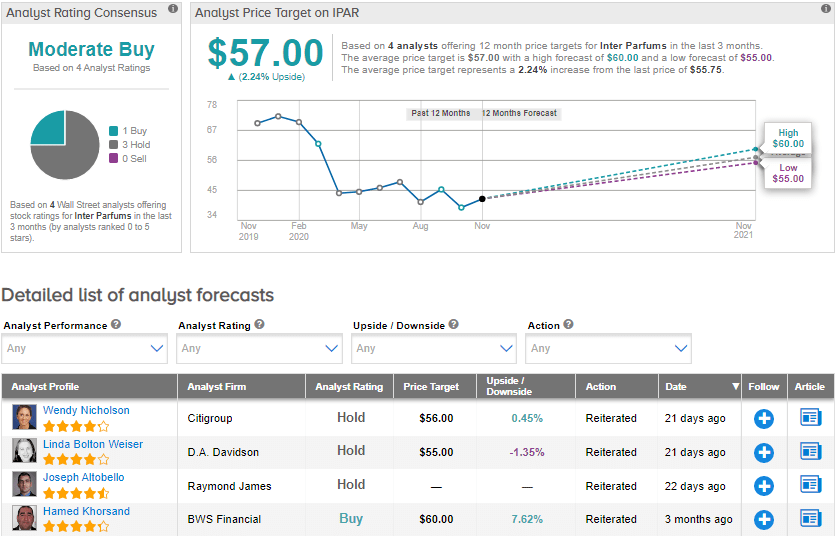

Despite the 3Q beat, Raymond James analyst Joseph Altobello reiterated a Hold rating on the stock. In a note to investors, Altobello said “While monthly trends continue to show gradual improvement ahead of a very robust launch schedule in 2021, the outlook over the next several quarters remains uncertain and results are likely to be quite choppy. At the same time, we believe IPAR’s lack of a meaningful e-commerce presence limits upside, the duty free channel is likely to remain severely impacted from a lack of air travel, while valuation is hardly compelling.”

Meanwhile, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 1 Buy and 3 Holds. The average price target stands at $57 and implies upside potential of about 2.2% to current levels. Shares have declined by 23.3% year-to-date.

Related News:

Zoom’s 3Q Profit Blows Past Estimates; Stock Drops 5%

AMD Jumps 6% As CEO Sees PC Growth In 2021; Stock Up 102% YTD

Corsair Gaming Boosts Guidance On Higher Demand; Wedbush Raises PT