At Bloomberg, they’re worried about chipmaker Intel (INTC). No, really. That is verbatim. The first four words of a Bloomberg podcast were “I’m worried about Intel.” And there is reason for concern; the last several weeks of news about the microchip maker have underscored that fact well.

The Bloomberg podcast started out by noting that the policy environment is looking good for Intel right now. That’s true. All anyone need do is look at the government handing over billions of dollars to help Intel get its foundry business off the ground. But Intel’s ability to execute is not looking so good.

And worse, Intel represents a major part of America’s industrial presence these days. For it to be faltering so much casts an aspersion on the rest of the country’s economy, even the rest of the country as a whole. Bloomberg is certainly not concerned for Intel without reason.

Some Good News

There was some minor good news related to Intel today. Recent reports found that the Falcon Shores GPU line of processors is likely to survive Intel’s recent cost-cutting measures. We know that Intel has lost employees and cutback on just about every expense imaginable. But its graphics processor line—which is also likely to play host to the Gaudi processor lineup—is not one of these cuts.

Intel also got a win at the hands of the Biden administration, which declared that Intel would be exempt from certain federal environmental reviews. Normally these reviews go hand-in-hand with government subsidies. The new legislation, however, will keep Intel and some other companies in line for CHIPS Act money from having to spend some of that money getting ready for environmental assessments.

Is Intel Stock a Buy, Hold or Sell?

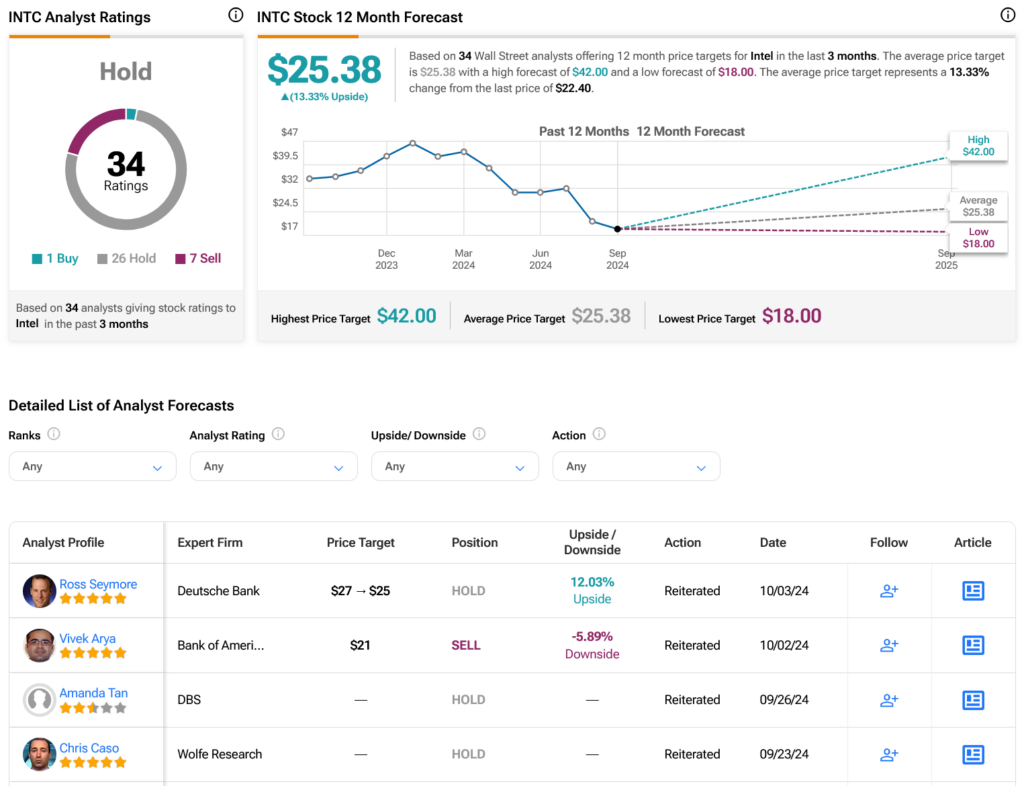

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 26 Holds and seven Sells assigned in the past three months, as indicated by the graphic below. After a 36.78% loss in its share price over the past year, the average INTC price target of $25.38 per share implies 13.33% upside potential.