A trending stock, Intel Corporation (NASDAQ: INTC), posted record fourth-quarter 2021 results, topping analysts’ expectations. Remarkably, both EPS and revenue exceeded the company’s guidance that was provided in October.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Meanwhile, the chipmaker provided disappointing first-quarter 2022 earnings expectations amid persistent global supply chain challenges. Additionally, management expects profit margins to remain under pressure in the long term, due to the 10-nanometer product ramp and increased process technology investment.

Following the mixed update, shares of the tech giant dipped 2.8% in the extended trading session on Wednesday.

Quarterly Results in Detail

Intel reported Q4 adjusted earnings of $1.09 per share, handily beating the Street’s estimates of $0.90 per share. It reported adjusted earnings of $1.48 per share in the same quarter last year.

Adjusted revenue of $19.5 billion surpassed consensus estimates of $18.32 billion and grew 4% year-over-year. An all-time record quarter for Data Center Group (DCG), record revenues at the Internet of Things Group (IoTG), and over $10 billion revenue contribution from the Client Computing Group (CCG), reflecting strong desktop PC and notebook demand, drove the results.

Intel’s DCG segment, IoTG, and Mobileye recorded 20%, 36%, and 7% year-over-year jumps in revenues. Outstandingly, strong server recovery in enterprise and government, along with the post-pandemic rebound in demand, acted as tailwinds.

Adjusted gross margin stood at 55.4%, down 460 basis points year-over-year.

Full-Year 2021 Results

For 2021, Intel reported adjusted earnings of $5.47 per share, up 7% year-over-year. Additionally, adjusted revenue of $74.7 billion grew 2%.

Intel CEO Pat Gelsinger commented, “We exceeded top-line quarterly guidance by over $1 billion and delivered the best quarterly and full-year revenue in the company’s history. Our disciplined focus on execution across technology development, manufacturing, and our traditional and emerging businesses is reflected in our results. We remain committed to driving long-term, sustainable growth as we relentlessly execute our IDM 2.0 strategy.”

Outlook

Looking forward, Intel CFO Dave Zinsner said, “We continue to see strong demand across all our businesses, and note that Q1 includes the impact of an additional 14th week. We expect results to be tempered by continued industrywide component constraints, normal seasonality, and PC notebook inventory burn as OEMs work through inventory imbalances created by ecosystem constraints that have limited their ability to ship systems in certain segments.”

For Q1, the company projects adjusted revenue of $18.3 billion, higher than the consensus estimate of $17.62 billion. Moreover, non-GAAP earnings are expected to be $0.80 per share, versus analysts’ expectations of $0.86.

The adjusted gross margin is forecast to be 52%.

Dividend Update

Intel’s board of directors announced a common stock quarterly cash dividend of $0.365 per share, up 5%. The new dividend will be paid on March 1 to shareholders of record as of February 7. The company’s annual dividend of $1.46 per share now reflects a dividend yield of 2.82%.

Wall Street’s Take

Following the results, Rosenblatt Securities analyst Hans Mosesmann reiterated a Sell rating and a price target of $40 (22.62% downside potential).

According to Mosesmann, Intel’s CCG PC units were down 18% year-over-year and cloud business remained lackluster, which indicates market share loss. Consequently, he maintained a negative stance, despite the upbeat Q4 results.

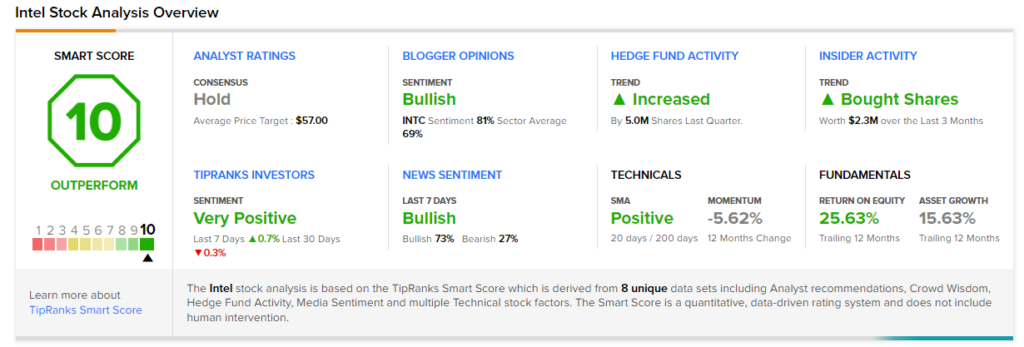

Overall, the stock has a Hold consensus rating, based on 4 Buys, 5 Holds, and 4 Sells. The average Intel price target of $57 implies 10.27% upside potential from current levels. Shares have decreased 5.4% over the past year.

Smart Score

Though Wall Street analysts seem cautious about Intel, the stock scores a “Perfect 10” from TipRanks’ Smart Score rating system. This makes it one of TipRanks’ Top Stocks and implies that the stock has strong potential to outperform market expectations.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

FedEx & Microsoft Reveal New E-commerce Logistics Solution

Microsoft: Upbeat Q2 Results, Strong Q3 Outlook

NextEra: Shares Drop Over 8% on Mixed Q4 Results, CEO Step Down