Contrarian investors, listen up. Are you willing to snatch up shares of a potential runner before the big move? Intel (NASDAQ:INTC) is poised to play catch-up, in my humble opinion, as the company has been in the market’s doghouse for far too long. I am bullish on INTC stock because, when the chips are down, and the champs are separated from the challengers, I fully expect Intel to rise to the top.

Don't Miss our Black Friday Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Just to recap, Intel is a giant semiconductor designer and seller that’s based in the U.S. but sells microprocessors worldwide. If you’re old enough, you might remember a time when Intel was the undisputed heavyweight champion among American semiconductor sellers.

Yet, nowadays, investors seem to favor Advanced Micro Devices (NASDAQ:AMD), Broadcom (NASDAQ:AVGO), and, of course, the almost universally worshiped Nvidia (NASDAQ:NVDA). In this context, Intel looks like a left-behind or an also-ran. Yet, if and when Intel transforms from a laggard to a leader, you’ll probably wish you had considered a share position when the haters and doubters were in charge.

The Reason Why Intel Stock Rallied for No Reason

Today, the stock market was about as flat as it could be. However, Intel stock rallied 6% for no apparent reason. Everything in the financial markets happens for a reason, though, especially as Intel is long overdue for a re-rating on Wall Street.

I searched far and wide for the reason why INTC stock jumped during a mostly flat day for the stock market. The usual social media gurus were out in full force, but actual insights were scarce.

The Wall Street Journal attempted to make sense of the unexpected rise of Intel stock, observing a broad-based rally in shares of “companies tied to the AI chip boom.” Indeed, there was a decent bump in the stock prices of Taiwan Semiconductor Manufacturing (NYSE:TSM), Advanced Micro Devices, Broadcom, and Nvidia today.

Yet, Intel stock outperformed them all. I’d say it’s because the stock underperformed the others for so long, and surprising things can happen when investors come to their senses and realize they’ve been unfair to a particular company.

We’ve seen the ending of this movie before. Do you recall how Intel was the laughingstock of the chipmaker industry in 2022, when social-media pundits mocked the company because it lost some market share to Advanced Micro Devices?

At that time, Intel stock traded at around $25. By the end of 2023, it had doubled to $50. Amazing things can happen when the market “forgives” a company that never really committed a sin in the first place.

Some Analysts See the Intel’s Catch-Up Potential

As we’ll discuss in a moment, analysts are generally mixed on Intel’s future prospects. However, some of them fully understand Intel’s potential to regain the market’s good graces.

First, Melius Research analysts seem to be bullish on Intel even though, unlike Advanced Micro Devices, Intel will have to spend a lot of money to develop its chip-foundry business. “AMD may be the ‘cleaner’ way to play these cycles since expectations have been lowered for its AI accelerators and it lacks Intel’s ‘foundry’ overhang. However, Intel is much more unloved into what could be a seasonal bounce,” Reitzes elaborated. He rates INTC stock with a Buy rating and a $37 price target.

Meanwhile, analysts with ClearBridge Investments “take a contrarian view of Intel,” which definitely resonates with me. They “do not think it will be an AI loser,” which some Advanced Micro Devices and Nvidia fans might assume Intel to be. Instead, the ClearBridge Investments analysts “see underappreciated opportunity as AI PCs ramp over the next few quarters in enterprises, where Intel has a stronghold.”

I agree 100% with that perspective, and I also concur with five-star investor Paul Franke’s stance on Intel. Rather than viewing Intel’s foundry business as a financial sinkhole, he observed, “Intel is rapidly transforming into a top U.S. foundry company to manufacture high-end semiconductors, with government funding support.”

Also, Franke feels that “Intel’s dislike by investors has reached extreme proportions,” and he even dared to suggest that INTC stock may be a “materially better choice for your portfolio than alternative semiconductor picks including Nvidia.”

Is Intel Stock a Buy, According to Analysts?

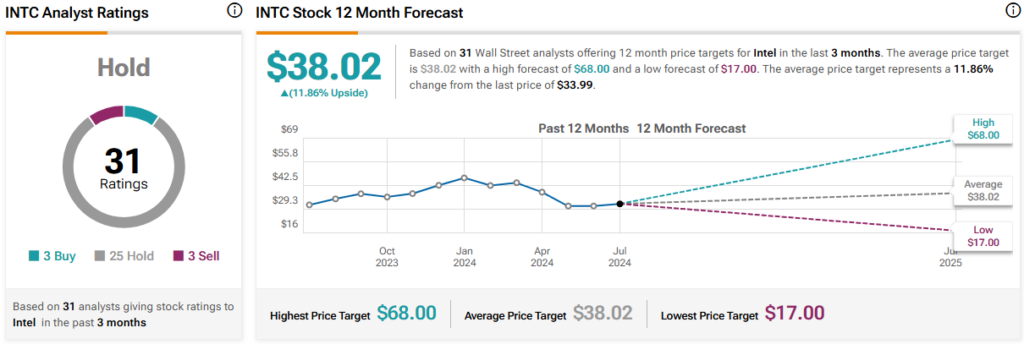

On TipRanks, INTC comes in as a Hold based on three Buys, 25 Holds, and three Sell ratings assigned by analysts in the past three months. The average Intel stock price target is $38.02, implying 11.9% upside potential.

Conclusion: Should You Consider Intel Stock?

A single-day Intel share-price rally isn’t very meaningful, but it does suggest that the stock could rally further for what looks like “no apparent reason.” Yet, since Intel has been underappreciated for too long, there is actually a valid reason for INTC stock to move higher.

Besides, even though Intel’s chipmaking-foundry business will cost a great deal of money for a while, it should provide Intel with excellent revenue-generating opportunities down the line. Hence, contrarian investors who dare to move against the crowd should certainly consider buying INTC stock.