Intel (INTC) is close to locking down $8.5 billion in direct funding from the U.S. government by the end of the year, according to the Financial Times. This funding, which is part of a larger effort to boost domestic semiconductor production, is critical for Intel as it tries to regain its footing in the competitive chip market.

U.S. Government Backs Intel’s Expansion

The U.S. government, led by President Joe Biden, has already awarded Intel close to $20 billion in grants and loans, part of which will go toward building two new factories in Arizona and modernizing an existing one. While talks are in the final stages, there’s no guarantee they’ll wrap up by year-end, with some concerns that a potential takeover of Intel’s business could throw a wrench in the plans.

Intel’s Fight to Regain Chip Dominance

Once a dominant force, Intel has struggled to keep pace with Taiwan Semiconductor Manufacturing Co. (TSM) and missed out on the generative AI chip boom capitalized on by Nvidia and AMD. However, the $8.5 billion in funding could help the company turn things around, especially as it invests in expanding domestic chip production.

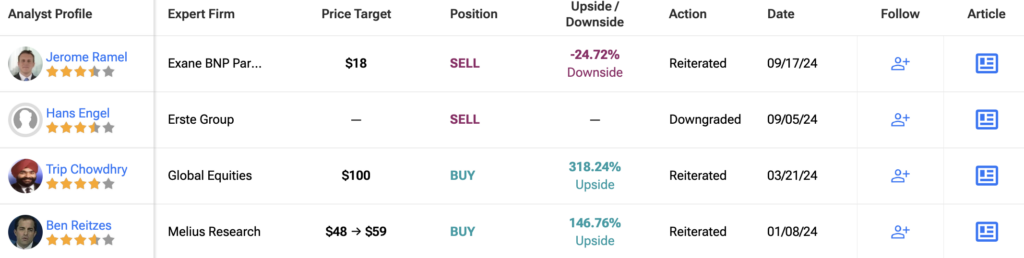

Is Intel a Buy, Sell or Hold?

On TipRanks, INTC is rated as a Hold, based on one Buy, 26 Holds, and seven Sell ratings assigned by analysts over the past three months. The average Intel stock price target is $25.47, implying 6.5% upside potential.