The CEOs of American semiconductor companies Intel Corp. (NASDAQ:INTC) and Qualcomm (NASDAQ:QCOM) are planning to visit the White House to discuss easing chip exports to China, Bloomberg and Reuters stated. The move comes as the Biden Administration seeks to further strengthen its export controls to China as the trade war between the two nations heats up steadily.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

China is considered one of the largest and most important markets for chip manufacturers. QCOM reportedly earns over 60% of its revenue from the mainland, while 25% of INTC’s sales are generated from the nation. Qualcomm sells chips to Chinese smartphone manufacturers such as Xiaomi Corp., and Intel’s advanced artificial intelligence (AI) chips garner huge demand in China.

Executives warn that diminishing revenues from China would ultimately hurt their ability to spend more on research and development of advanced chips. This will indirectly hurt the U.S.’s ambition to be a global leader in advanced chip manufacturing. The CEOs of the companies are hoping to convince officials that they refrain from passing any stricter laws on exports to China, as well as discuss their views on future market conditions and other matters affecting their businesses.

Chip Companies Caution Against Export Restrictions

Bloomberg also noted that Nvidia Corp. (NASDAQ:NVDA) CEO Jen Hsun Huang will be accompanying INTC CEO Patrick Gelsinger and QCOM CEO Cristiano Amon on their lobbying trip to Washington. China provides roughly one-fifth of Nvidia’s revenue, and Huang has consistently cautioned about the loss of business to Nvidia if the curbs are strengthened further. Executives of other smaller semiconductor companies could also accompany the trio, according to reports.

Gelsinger’s visit to Washington will also pave the way for its pending $5.4 billion acquisition of Tower Semiconductor Ltd. (NASDAQ:TSEM), which awaits Chinese regulatory approval. Meanwhile, Qualcomm, which has a license to export its chips to Huawei Technologies, is under pressure as the U.S. considers employing tighter rules on exports to the company. If the U.S. continues to employ stringent export protocols, it could provoke China to do the same, leading to a power struggle that would hurt both economies.

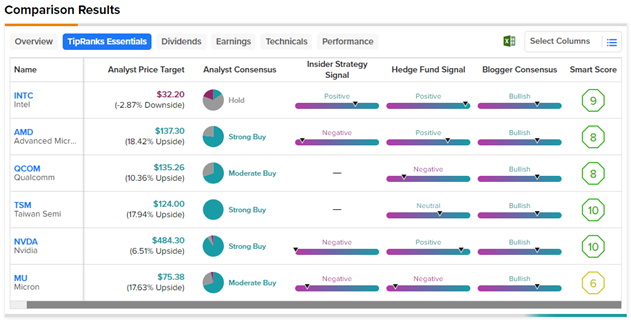

Chip Stocks Comparison

We checked out the leading chip stocks through the TipRanks Stock Comparison Tool. As shown in the chart below, AMD and TSM stocks currently have the highest upside, according to analysts.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue