Normally, job cuts tend to help a company’s stock price. They represent substantial cost savings and demonstrate a willingness to do what is necessary for the company as a whole. But chipmaker Intel (INTC) is proving somewhat different here. Shares are up over 6% in Thursday afternoon’s trading, but shareholders are actively suing the company following its recent stock plunge.

The lawsuits, recently filed in San Francisco federal court, alleged that Intel concealed the problems that ultimately led to its disappointing results, which spawned a slew of job cuts and led to it shutting down its dividend. The class action lawsuit targets not only Intel but also CEO Patrick Gelsinger and CFO David Zinsner.

The allegations are that Intel offered “….materially false or misleading statements regarding the business…from January 25 to August 1.” Intel itself, meanwhile, had no comment about the lawsuit when asked by Reuters.

Stepping Into Automotive

The news was not all bad, however. Intel took a new step into the automotive sector, rolling out its first-ever discrete graphics processing unit (dGPU). Dubbed the Intel Arc Graphics for automotive, the chip will be put in cars starting next year, and this will allow for a range of new options, including personalization features for drivers and manufacturers alike.

The car will effectively be able to better learn driver preferences and, in turn, provide a better experience, which should drive more interest in the cars that offer such features.

Is Intel a Buy, Hold, or Sell?

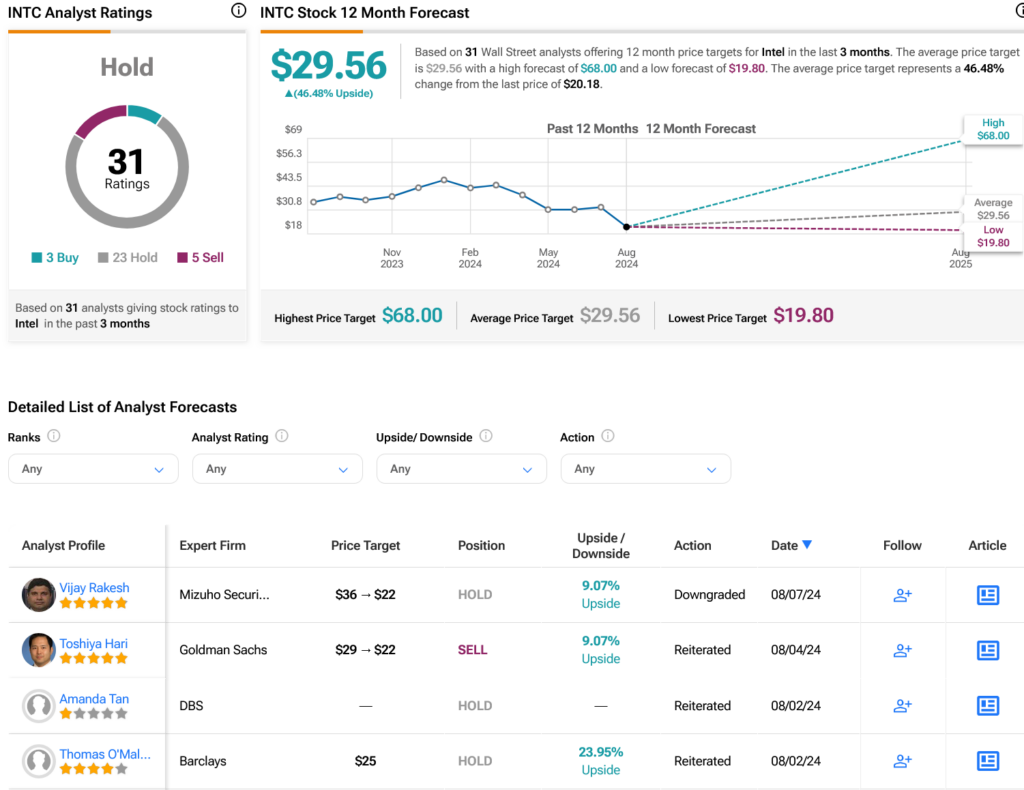

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on three Buys, 23 Holds, and five Sell assigned in the past three months, as indicated by the graphic below. After a 40.57% loss in its share price over the past year, the average INTC price target of $29.56 per share implies 46.48% upside potential.