Recent news out of chip maker Intel (INTC) has not been good. We have seen layoffs, asset sales, and a potential loss of federal money that Intel was likely counting on. And the latest news—a three-day mass board meeting to try and figure a way out of this set of problems—has not delivered much help. Intel is down fractionally once again in Thursday afternoon’s trading as a result.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Intel’s board started its three-day meeting frenzy on Tuesday and reached its conclusion today. It all started after Intel’s earnings report failed to deliver much positive news, with Intel going from a net profit of $1.5 billion to a net loss of $1.6 billion. And the outlook for the next quarter does not look much brighter.

Meanwhile, the board is working on options. Several have been floated already, some to greater effect than others, but no one is quite sure just what it will be that turns Intel around and pushes it back to its former greatness. And with CEO Pat Gelsinger’s master plan for Intel reportedly now in tatters, it remains to be seen what the last three days of meetings will ultimately generate for Intel.

Selling Altera? Not So Fast, Says Its CEO

One of the ideas recently floated was the notion that Intel might sell off Altera. We heard about that one earlier this month, though it was advanced more as a possibility than an actual event. And the CEO of Altera, Sandra Rivera, recently stepped out to perform some rumor control about this notion.

Rivera denied the reports that Altera might have been up for sale, declaring that the report in question was “…not sourced from anyone that actually knows what’s happening.” Given that the report originally came from Reuters, the question remains. Rivera went on to declare that Intel was committed to its original plans regarding Altera, and an initial public offering (IPO) is still scheduled to happen in 2026.

Is Intel a Buy, Sell, or Hold?

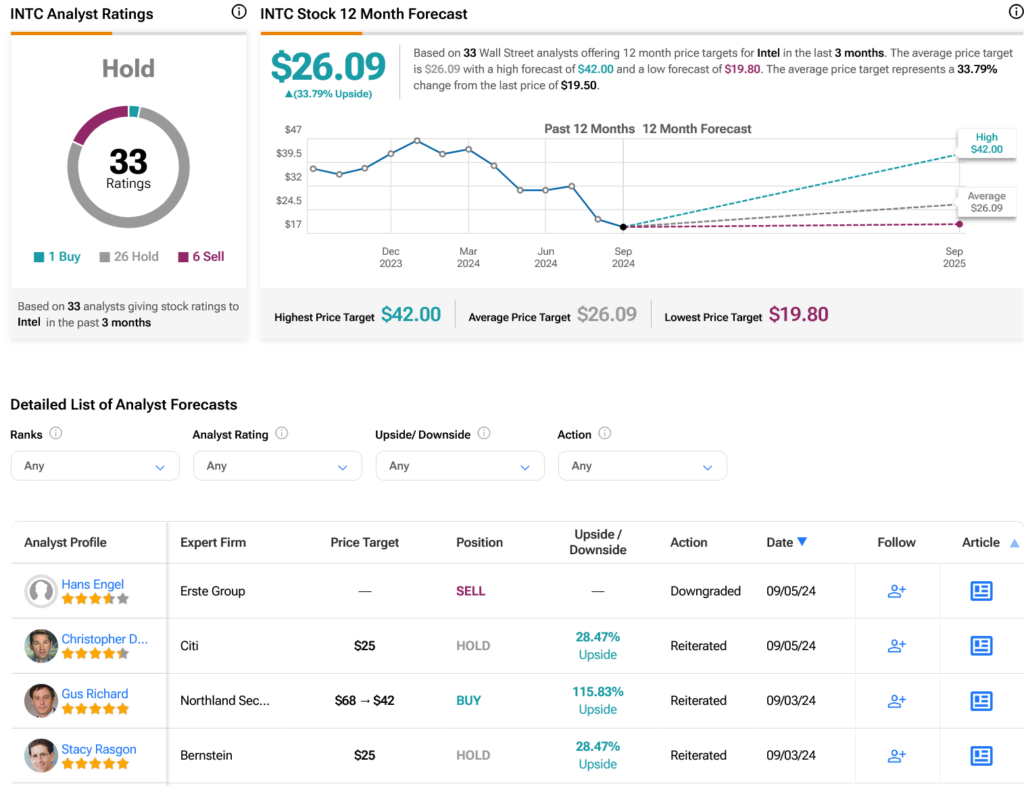

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 26 Holds, and six Sells assigned in the past three months, as indicated by the graphic below. After a 48.91% loss in its share price over the past year, the average INTC price target of $26.09 per share implies 33.79% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue