Yesterday, we found out about the possibility of new Arc-series graphics cards coming out from chip stock Intel (INTC), and today, things went a little farther. With 2025 now just hours away—depending, of course, on where you are—there is another new product development waiting to kick off the year. And investors were not unhappy about this, giving Intel shares a modest boost in Tuesday afternoon’s trading.

This time around, Intel is getting together new Chromebook laptops powered by the Panther Lake chip line. The baseboards Intel will be adding to these Chromebooks are currently known as “Fatcat” laptops, and should be arriving “throughout 2025,” according to a report from Chrome Unboxed.

The new line will have a particular onus to deliver improvements in battery life as well as matching—or exceeding—performance enhancements seen throughout the broader industry. Yet the reports suggest that Panther Lake is up to the task, as long as it can deliver on earlier promises. With growing competition from several different firms emerging, and Intel increasingly seen as a sector laggard, it will have to produce a winner to get back its lost reputation. No specs are available as yet, but early word says to look for improvements in speed and artificial intelligence (AI) use.

“Sometimes Mr. Fix-It Is Too Late.”

And this leads into a report from the Wall Street Journal, in which Intel offers up a “grim lesson” for Boeing (BA), that sometimes “….Mr. Fix-It is too late.” Intel and Boeing are in a similar position right now. Both have recently shuffled their CEOs, and both have been facing catastrophic impacts to their reputations in recent months as products do not live up to standards.

While there are plenty of differences between the two; Boeing got “the big picture right,” the report notes, while Intel faced “…mistakes (that) were both product and production related,” both are looking to new CEOs to fix things and get the company righted around. But when an entire company is counting on one man, sometimes, that man is tossed out before the fixes can get done as investors clamor for quick fixes to save their investments. Thus, sometimes, Mr. Fix-It arrives too late.

Is Intel a Buy, Hold or Sell?

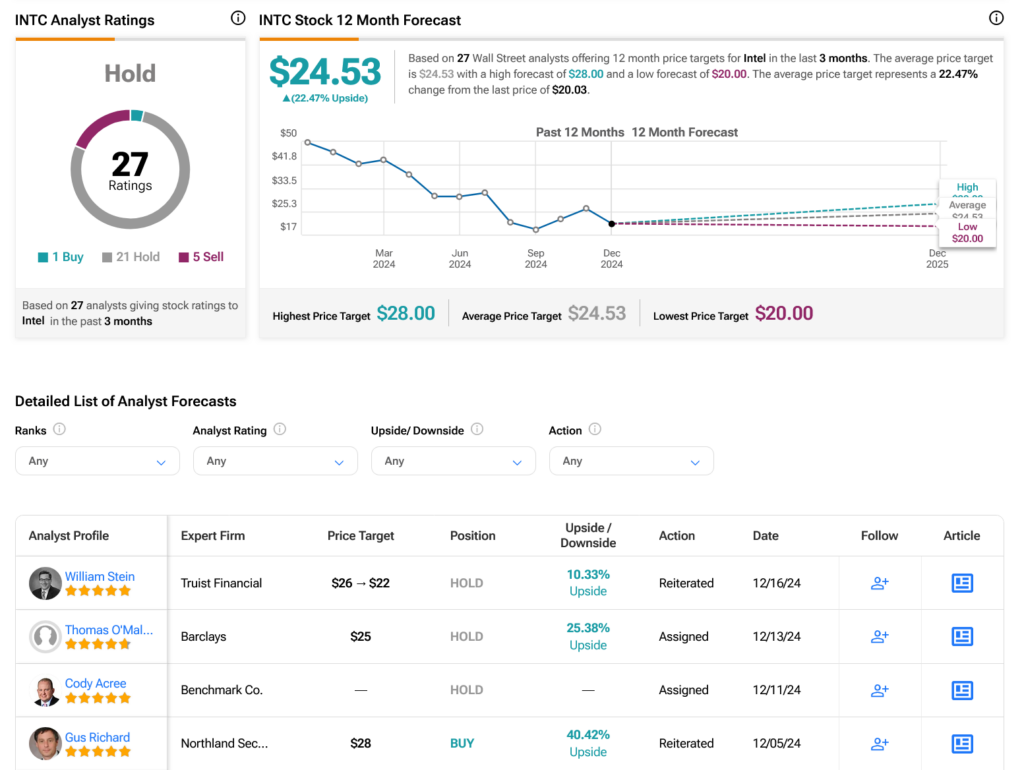

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 21 Holds and five Sells assigned in the past three months, as indicated by the graphic below. After a 57.73% loss in its share price over the past year, the average INTC price target of $24.53 per share implies 22.47% upside potential.

Questions or Comments about the article? Write to editor@tipranks.com