If you were wondering if, perhaps, chip stock Intel (INTC) might have a bit of a cash crunch on its hands, then you’ll have one more reason to wonder as much with the latest update. Intel sold off its entire stake in Arm Holdings (ARM), a move which did little to endear it to investors. As a result, Intel shares were down over 2% in Wednesday afternoon’s trading.

Previously, Intel held 1.18 million shares in Arm Holdings, and now, it has none. What it has, however, is $146.7 million in cash, based on the average share price from April to June. This is on top of its recent dividend suspension and, of course, massive job cuts.

Some attribute this sudden lack of cash to Intel’s ongoing plans to make a name for itself in the foundry market as it works to become a major chip-producing operation. Regardless of the reason, it has become clear with this move that the company is looking to boost its liquidity and efficiency.

Internal Processes Lending Support

So, we have seen the liquidity part of Intel’s recent move, but how about the efficiency? That is proceeding apace as well, reports note, as the first external customer for the Intel 18A process will tape out in the first half of 2025.

For a while, much of Intel’s advancement—much like that of the industry as a whole—was done simply via incremental improvements like “…focusing on transistor poly pitch or gate oxide thickness.” But 18A looks to improve things by focusing on the entire system as opposed to small pieces of it. With a growing amount of interest in turning to Intel for advanced packaging, this may help Intel pull some business back and help improve its bottom line.

Is Intel a Buy, Hold, or Sell?

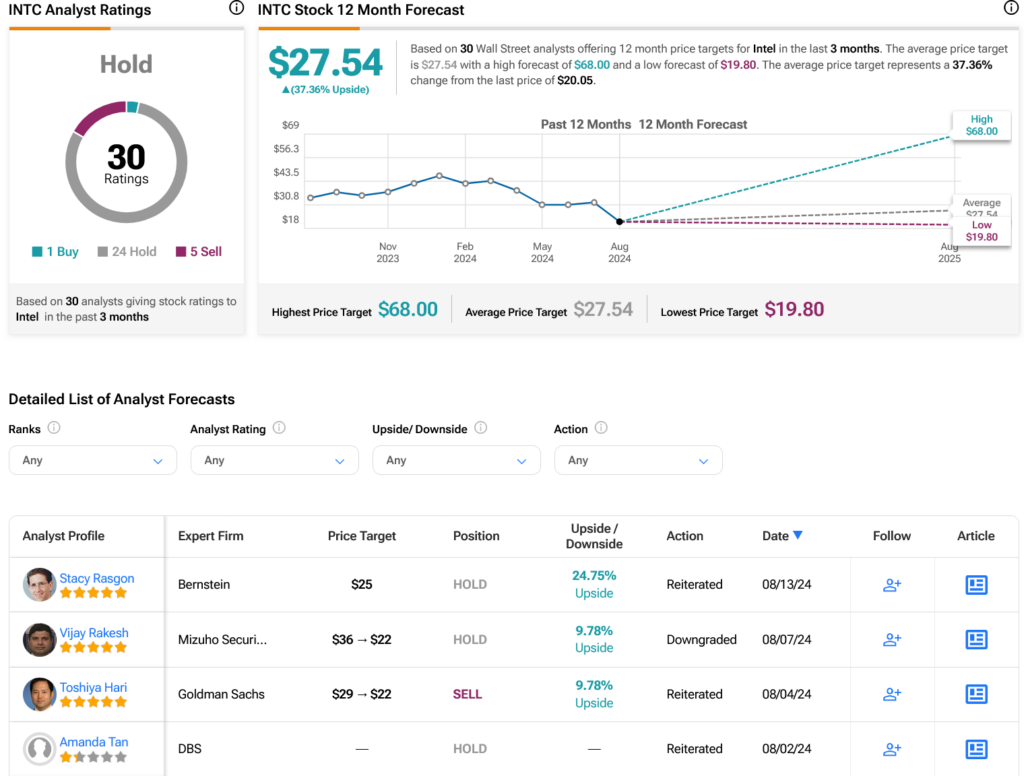

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 24 Holds, and five Sells assigned in the past three months, as indicated by the graphic below. After a 41.4% loss in its share price over the past year, the average INTC price target of $27.54 per share implies 37.36% upside potential.