Layoffs that take place during a holiday might be the worst kind of all. Not only does it hit those laid off particularly hard, but it also seldom works well for shareholders, who are concerned about how such a layoff looks, as companies firing right before Christmas have discovered. Chip stock Intel (INTC), meanwhile, was poised to launch a set of layoffs in Israel, measuring in the “hundreds” range, but pulled its decision back two weeks to the end of October.

Apparently someone took a look at a calendar and noticed that Yom Kippur took place on Friday, which represents a major Jewish holiday. And with Simchat Torah set to hit on October 24, most Intel employees will not even return until October 27. Intel, understandably, likely did not want to fire a roomful of people who were not even in the room at the time.

This latest round of cuts is part of Intel’s larger plan to pare back $10 billion worth of costs, which includes the loss of 15,000 employees. Reductions in benefits and leasing programs previously took place, and several employees took voluntary buyout offers to depart the company.

A New Albany Update

Meanwhile, over at the one part of Intel where spending continues almost unabated, there is an update on the New Albany project. The semiconductor manufacturing operation is still under construction and will continue to be for some time to come. In fact, the whole thing will be officially operational between 2027 and 2028.

The project began construction back in 2022 but will not even be complete until at least 2026. Thus, Intel’s cost-cutting measures will likely continue for some time to come as it commits a lot of cash to its foundry operations. Further, two more new plants are apparently firing up in Licking County, Ohio, with plans to start them up potentially in 2025.

Is Intel a Buy, Hold, or Sell?

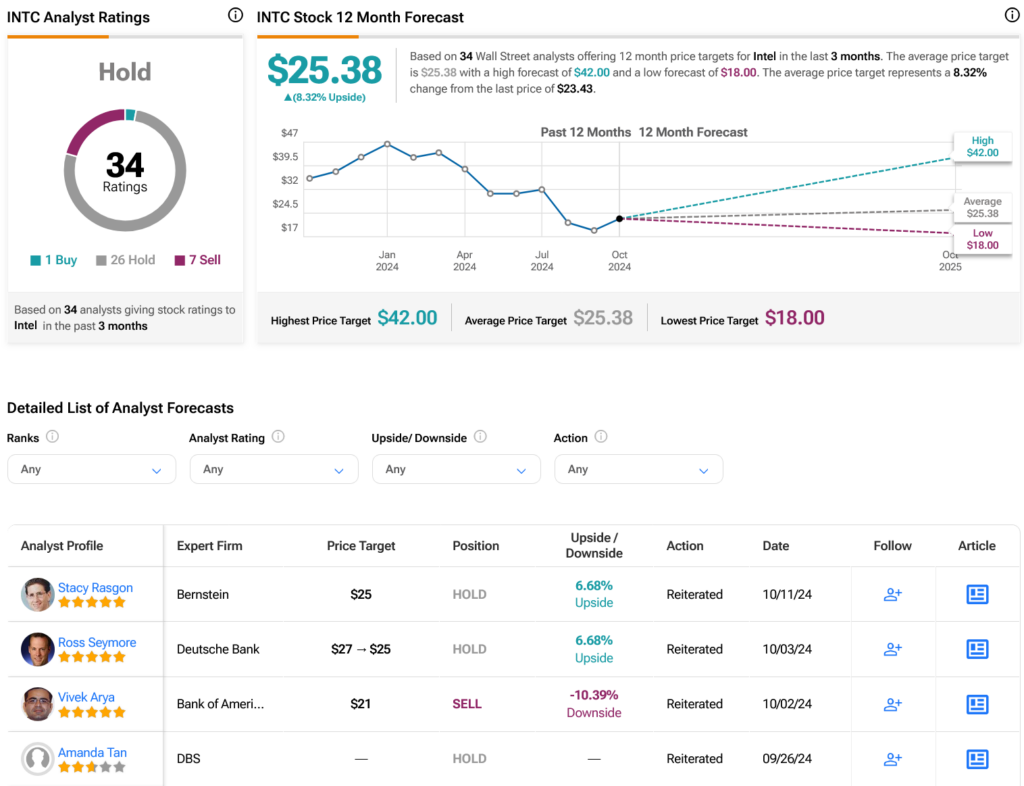

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 26 Holds, and seven Sells assigned in the past three months, as indicated by the graphic below. After a 34.83% loss in its share price over the past year, the average INTC price target of $25.38 per share implies 8.32% upside potential.