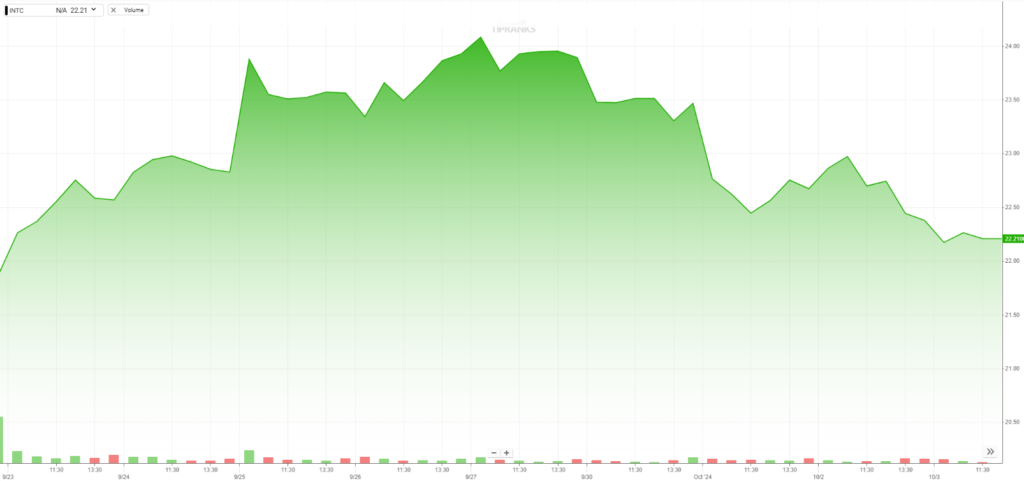

Intel Corp shares (INTC) shares were trading lower for a fifth consecutive day on Thursday, October 3, as restructuring, spin-off, and takeover rumors have taken a break. Traders are also refocusing their attention to new developments in the middle-east.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Shares of the beleaguered former semiconductor leader had risen 6 straight sessions from September 19 – 26 as market participants weighed the prospect of deals between Intel and other firms who had expressed interest in the fallen giant’s business. Companies including Arm Holdings (ARM), Apollo Global Management (APO), and Qualcomm (QCOM) were cited as parties interested in parts of Intel’s business or the entire corporation. That led to a ~20% rally in the shares from mid-September until last week.

Intel shares have now given up about half those gains, as markets enter a wait-and-see mode. Many of the potential business combinations have been debunked by some observers but lauded by others as Intel Corp’s path to redemption.

Intel Third-Quarter Earnings Expectations

With the month of September now behind us, earnings season will be back in gear by the middle of October. If there are no further developments regarding Intel’s possible business partnerships in the next few weeks, INTC shareholders will begin to turn their attention to the company’s upcoming Q3 report slated for release on October 31st. It was the Q2 report that sent INTC stock into freefall, and many investors will be searching for any sign of hope from the next earnings announcement and management call.

The consensus revenue estimate for Intel’s Q3 is $13.04 billion, while the bottom line is expected to be a loss of $0.03/share (non-GAAP). If the company hits the revenue target, it will represent an 8% decline in sales from Q3 of 2023.

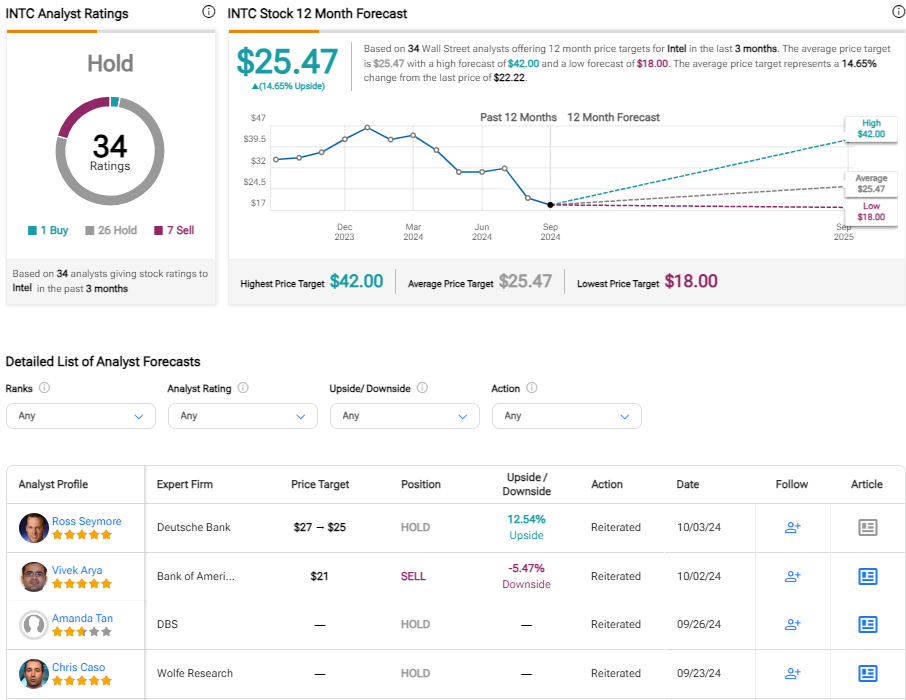

How Does Wall Street Rate Intel Stock?

Based on 34 Wall Street analyst ratings, TipRanks has a consensus Hold rating on Intel stock. Only one of those analysts has a Buy rating on INTC, against seven Sell ratings. 26 analysts give the stock a Hold rating. The average INTC price target is $25.47, which represents about 15% potential upside.