At the Wall Street Journal’s (WSJ) Tech Live conference held on October 24, chip giant Intel’s (NASDAQ:INTC) CEO Pat Gelsinger stated that the recently imposed restrictions by the Biden Administration on chips and related technology exports to China were inevitable.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The new controls implemented by the U.S. require companies to apply for a license if they want to export advanced chips to China or supply Chinese companies with tools to build their own advanced chips. The move is expected to slow down Beijing’s technological and military advances.

As per a WSJ report, Intel CEO Gelsinger stated, “I viewed this geopolitically as inevitable.” He further added, “And that’s why the rebalancing of supply chains is so critical.”

Intel was one of the U.S. chipmakers that aggressively lobbied for the passing of the CHIPS and Science Act. The Act, which was signed into law in August 2022, allocates nearly $53 billion toward semiconductor research, development, and incentives to support domestic manufacturing.

Gelsinger feels that the efforts to boost domestic chip manufacturing in Western countries will help bring down Asia’s contribution from about 80% to about 50% by 2030, with the U.S. accounting for 30% and Europe contributing the remaining 20%.

Intel is aggressively investing in the expansion of its manufacturing footprint, including an initial investment (announced earlier this year) of more than $20 billion to build two chip factories in Ohio.

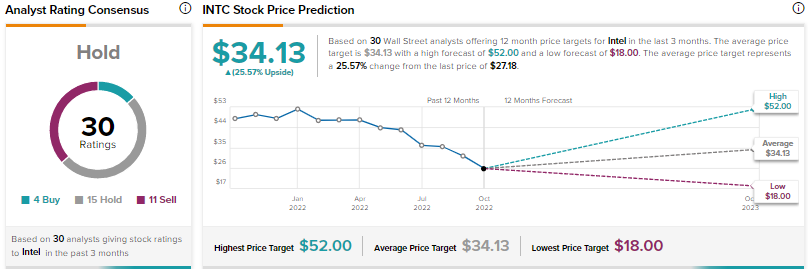

What is the INTC Price Target?

Intel has been losing ground to rivals like Advanced Micro Devices (AMD) due to a lack of innovation and delays in new launches. INTC stock has declined over 47% year-to-date due to macro pressures. The company is scheduled to announce its Q3 results on October 27.

Ahead of the results, Wall Street analysts are sidelined on INTC stock. The Hold consensus rating is based on four Buys, 15 Holds, and 11 Sells. The average Intel stock price target of $34.13 suggests 25.6% upside potential from current levels.