Shares of Interactive Brokers (IBKR) have declined 28.7% so far this year. The global electronic broker provides services across equities, derivatives, bonds, and exchange traded funds (ETFs) as well as cryptocurrencies.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

A slump in markets means lower trading activity and daily volumes, which can affect brokerages. In May, IBKR reported around 2.3 million daily average revenue trades (DARTs), recording a 2% year-over-year growth. Ending client equity at $314.6 billion had decreased 10% from a year-ago period.

These metrics have worsened for the month of June. DARTs, at around 2.02 million, were down 18% over the prior year and 12% for May. In sync, ending client equity at $294.8 billion is down 19% over the prior year and 6% for May.

Further, the TipRanks website traffic tool indicates the total traffic to IBKR globally has dropped from 2.81 million in March 2021 to 2.12 million in May 2022.

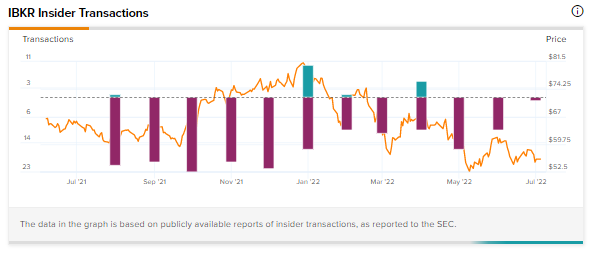

If the markets continue to decline for the remainder of 2022, these figures could take a further hit. Concurrently, our data crunch at TipRanks shows major insiders at IBKR have been exiting the stock over the past month.

Thomas Peterffy, the Chairman and Director at IBKR, has offloaded 440,000 IBKR shares to the tune of $25.44 million. The latest Sell by Peterffy came on July 1 for $2.25 million. His current IBKR holdings are valued at $110.92 million.

The other two major names to offload IBKR stock over the past month are its CEO and Director, Milan Galik, and CFO and Director, Paul Jonathan Brody. The two have sold IBKR shares worth $2.6 million and $1.13 million, respectively, over the past month. Their current holdings in the company are roughly valued at $61.37 million and $38.53 million, respectively.

Bullish Hedge Funds

At the same time, the TipRanks database indicates hedge funds have increased holdings in the stock by 447,800 shares over the last quarter, which indicates a very positive hedge fund confidence signal.

Most importantly, two of the biggest names on Wall Street have initiated fresh positions in IBKR. Ray Dalio’s Bridgewater Associates has picked up IBKR stock worth around $12.69 million. Similarly, George Soros’ Soros Fund Management has picked up IBKR shares worth about $1.98 million.

Closing Note

As bears take charge of equities and the crypto winter sets in, trading volumes may drop further as investors get discouraged from the markets, which could further impact IBKR.

Insiders dumping the stock at such a juncture can further dampen investor sentiment and the stock price. All eyes will be on IBKR’s second-quarter numbers on July 19. The Street expects IBKR to post EPS of $0.93 an increase from the year-ago figure of $0.82.

Read full Disclosure