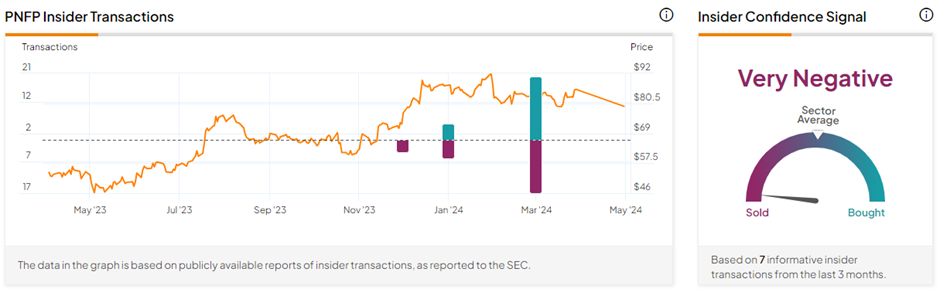

Two of Pinnacle Financial Partners’ (NASDAQ:PNFP) more-than-10% owners, Robert A Jr. Mccabe and Terry Turner, have been actively selling PNFP stock. The two insiders sold PNFP shares worth $15.17 million on April 25, 2024. While insiders often offload their shares for various reasons, including liquidity, a significant sale transaction might reflect a lack of confidence in the company’s growth potential.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Pinnacle Financial Partners provides a full range of banking, investment, trust, mortgage, and insurance products and services to individuals and businesses.

A Closer Look at Insiders’ Transactions

As per the Form 4 filing with the SEC, both insiders executed the sales through multiple transactions of PNFP shares on April 25. Insider Robert A Jr. Mccabe is the Chairman and director of PNFP, while Terry Turner is the CEO and director.

As per the regulatory filing, Mccabe sold 115,249 shares of PNFP worth $9,340,032. Meanwhile, Turner sold 72,000 shares of PNFP for $5,830,153 on April 25. Following the most recent share sale, Mccabe now holds shares worth $31.61 million and Turner holds shares worth $22.36 million of the bank holding company.

It is worth noting that both these insiders undertook similar simultaneous Informative share sales worth roughly $1.9 million each on March 12.

Pinnacle Financial Partners has a Very Negative Insider Confidence Signal on TipRanks based on Informative Sells worth $8.2 million undertaken in the last three months. Please note that the latest share sale reported on April 29 is not included in this count.

It is vital to keep an eye on the Informative trades of corporate insiders, given their knowledge of a company’s growth potential. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is PNFP a Buy?

In Q1 FY24 results, PNFP posted adjusted EPS (earnings per share) of $1.53 per share, missing the consensus of $1.54 per share. However, revenue of $428.14 million beat analysts’ estimates of $422.5 million.

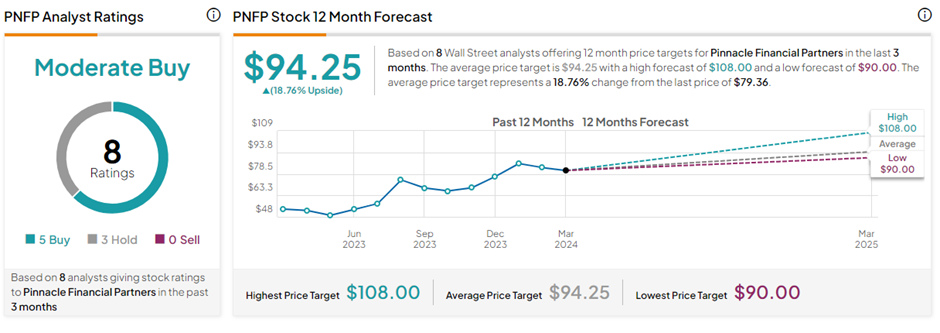

Analysts are split on PNFP’s stock trajectory. With five Buys and three Hold ratings, PNFP stock has a Moderate Buy consensus rating on TipRanks. The average Pinnacle Financial Partners price target of $94.25 implies 18.8% upside potential from current levels.