One of PBF Energy’s (NYSE:PBF) more-than-10% owners, Control Empresarial de Capitales S.A. de C.V., recently disclosed a huge purchase of the company’s shares, totaling $23.1 million. It is worth mentioning that Control Empresarial de Capitales S.A. de C.V. is an investment firm.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

PBF Energy is a petroleum refining and supply company that provides various petroleum products in North America.

Insider on a Buying Spree

As per the SEC filing, the insider bought 521,400 shares of the company on June 12 and June 13. Before this, the insider had purchased 537,500 shares between June 3 and June 10 for about $24.4 million.

Furthermore, Control Empresarial de Capitales bought PBF stock worth $20.8 million and $53.7 million between January 12 and January 17, 2024. The total value of PBF Energy stock in the insider’s portfolio currently stands at $188.42 million.

As per the data collected by TipRanks, Control Empresarial de Capitales has witnessed a 57% success rate on its trades in the past three months. Further, the insider has generated an average return of 5.8% per transaction.

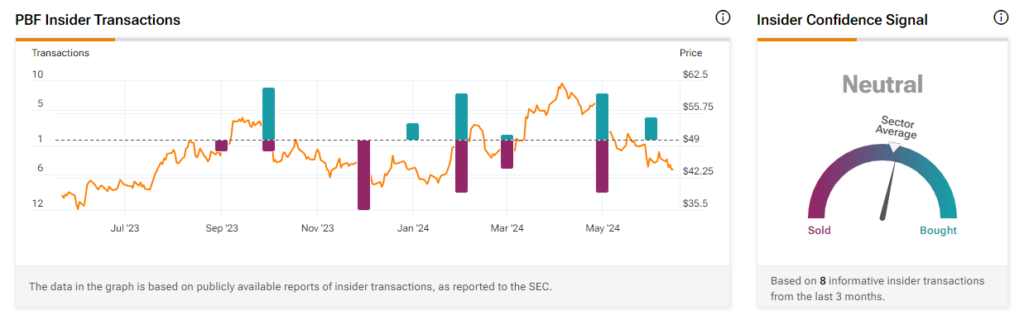

Neutral Insider Trading Signal

Overall, corporate insiders have bought PBF Energy stock worth $39 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in the stock is currently Neutral.

Investors may benefit from keeping an eye on transactions made by key insiders, as these transactions typically reflect their confidence in the company’s prospects. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Top-Analyst Neutral on PBF Stock

Recently, five-star analyst Ryan Todd from Piper Sandler reiterated a Hold rating on the stock and lowered the price target to $47 (implying 24.8% upside potential) from $54. (To watch Todd’s track record, click here.)

The analyst believes that the company’s refining margins will continue to remain under pressure due to weak demand for refined products. As a result, Todd lowered its Q2 earnings estimates by 43%.

Is PBF Stock a Good Buy?

Overall, PBF has a Moderate Buy consensus rating on TipRanks based on two Buy and five Hold recommendations. The analysts’ average price target on PBF Energy stock of $54.86 implies a 24.8% upside potential. Shares of the company have gained 13.7% over the past year.